Stress test confirms ABN AMRO’s strong capital position

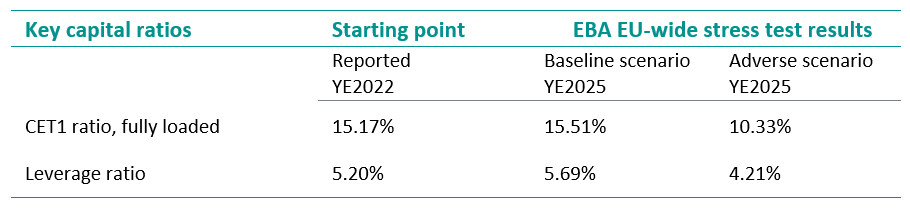

The EBA has performed an EU-wide stress test which resulted under the adverse scenario in a decrease of our CET1 capital ratio of 4.84% to 10.33% at year-end 2025, and an increase of 0.34% to 15.51% under the baseline scenario

The stress test does not contain a pass or fail threshold

The regulator will use the result of the stress test in the upcoming SREP process

Today, the European Banking Authority (EBA) published the results of the 2023 EU-wide stress test for European banks, including ABN AMRO. The starting point for the stress test was a 15.17% Basel III CET1 ratio at year-end 2022. The stress test resulted in a CET1 capital ratio of 15.51% under the baseline scenario and a CET1 capital ratio of 10.33% under the adverse scenario, both at year-end 2025.

The stress test is designed by regulators and is used in determining capital requirements as part of the upcoming Supervisory Review and Evaluation Process (SREP). It allows the regulator to assess the ability to meet prudential requirements under stressed scenarios. It supports the regulator in discussing risk mitigating actions. The stress test also aims to enhance transparency among banks. This stress test does not contain a pass or fail threshold.

Scenarios and assumptions

The adverse stress test scenario was set by the European Central Bank and the European Systemic Risk Board and covers a three-year time horizon (2023-2025). The adverse scenario is very severe having in mind a tough macroeconomic scenario for the Netherlands, especially for Residential Real Estate, with a cumulative house price drop of c.32% over the 3-year horizon.

The stress test has been carried out applying a static balance sheet assumption and therefore does not take into account future management actions. It is not a forecast of ABN AMRO profits.

The baseline scenario, mainly impacting net interest income, resulted in a fully loaded CET1 ratio of 15.51% and a leverage ratio of 5.69%, both at year-end 2025. The adverse scenario, also impacting loan impairments, operating costs and risk-weighted assets, resulted in a decline of the CET1 ratio to 10.33% and a leverage ratio of 4.21%.

The outcome of this stress test will be taken in consideration by the regulator when determining the SREP requirements for 2024. ABN AMRO continues to aim for strong capital ratios, even under stress, in accordance with its risk profile.