How sustainable investment works at ABN AMRO

How sustainable are ABN AMRO’s investment services? As sustainable as each individual investor wants them to be, says Global Head of Investment Services & Sustainability Solange Rouschop. ‘We give investors the knowledge to make a considered decision within a wide range of choices.’

How much capital does ABN AMRO have invested in sustainable investments?

‘ABN AMRO has sustainable investments totalling more than five billion euros, most of which are in sustainable investment mandates. A mandate means the client has asked us to invest their money for them. Sustainable mandates have grown explosively in recent years compared with other, traditional asset management mandates. We saw growth of 20 per cent in 2014, and this trend continued in 2015.’

Is a sustainable investment mandate the only way for clients to invest sustainably?

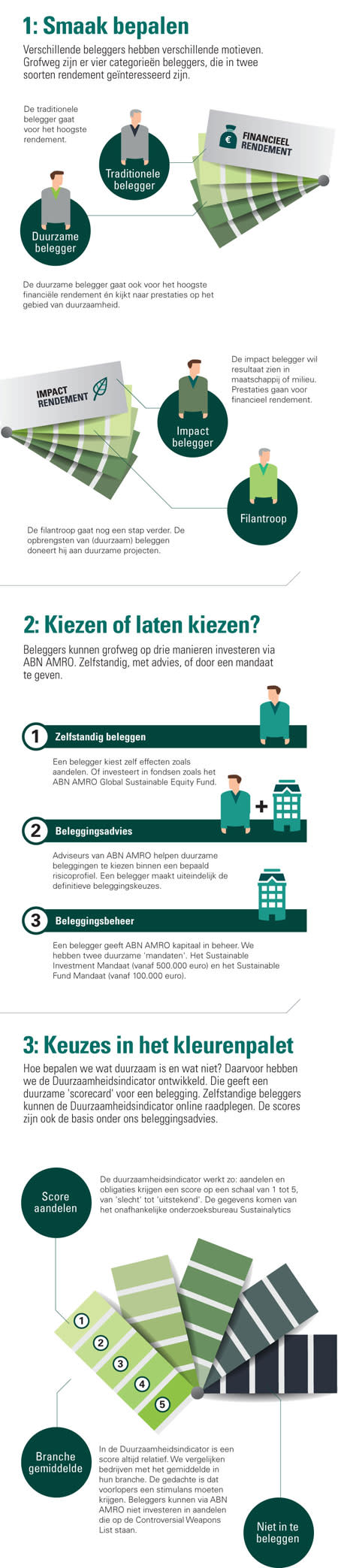

‘No, other options are also available. Clients can invest independently through us or based on our experts’ advice. In that case, the client selects the composition of the portfolio and the degree of sustainability. We help by providing information on sustainability.’

What is – and what isn’t – sustainable investment?

‘We always try to bring the total picture into focus. That’s why we developed the . We use this indicator to benchmark the companies behind shares and bonds, meaning we compare the firm’s sustainability with that of other market players. This allows us to see who is doing relatively well and who isn’t. We want to reward the front-runners among listed companies and warn the laggards.’

How does the Sustainability Indicator work?

‘A share or bond is rated on a scale of 1 to 5, from “excellent” to “poor”. We base our decision on information provided by Sustainalytics research agency, which continuously adjusts ratings based on the latest developments. We look at social, governance and environmental aspects. This means that a laggard in a relatively sustainable market can score a 5, and a front-runner in a less sustainable market a 1. Independent investors and our investment advisors can use the Sustainability Indicator to determine how sustainable a company is.’

Are there any shares or products in which ABN AMRO clients cannot invest?

‘Yes. Clients cannot invest via ABN AMRO in shares of companies that are involved in the production or distribution of controversial weapons. So even with “traditional” investments, we exclude certain companies and products. We do not necessarily exclude shares of companies that are not sustainable. We would rather engage them in a dialogue so that we can exert our influence.’

What does it mean to engage non-sustainable companies in dialogue?

‘We try to convince companies that, for example, violate human rights or environmental standards to change their ways. In collaboration with RobecoSAM, we encourage them to embark on an improvement process. If that does not yield results within a few years, we can always decide to exclude the share from our investment offering. It’s a last resort measure, but we often exert more influence by talking than by excluding companies.’

What does ABN AMRO believe is the key to success for sustainable investment?

‘More and more investors are aware of sustainability issues and make well-considered investment decisions. If there’s a demand for sustainability, the supply will become sustainable. ABN AMRO helps investors make decisions that are both financially profitable and fit for the long term. We believe that sustainable investment will ultimately become mainstream because it’s smart investment. Why wouldn’t an investor make sustainable investments?’