Global Monthly - Five themes to watch over the summer

As we approach the summer holiday period, we preview five major themes to watch. We start with the repricing of central bank rate cuts, which we think has further to run. This will likely be helped along by our second theme – the US economic slowdown. We also preview upcoming elections, explore the drivers of the recent rise in shipping freight tariffs, and finally, we flag the potential for eurozone services activity to see a boost from summer cultural events. As is customary in summer, we will take a break in July, resuming publication in late August.

Global View: From soft landings to Swiftonomics, there is enough to keep an eye on

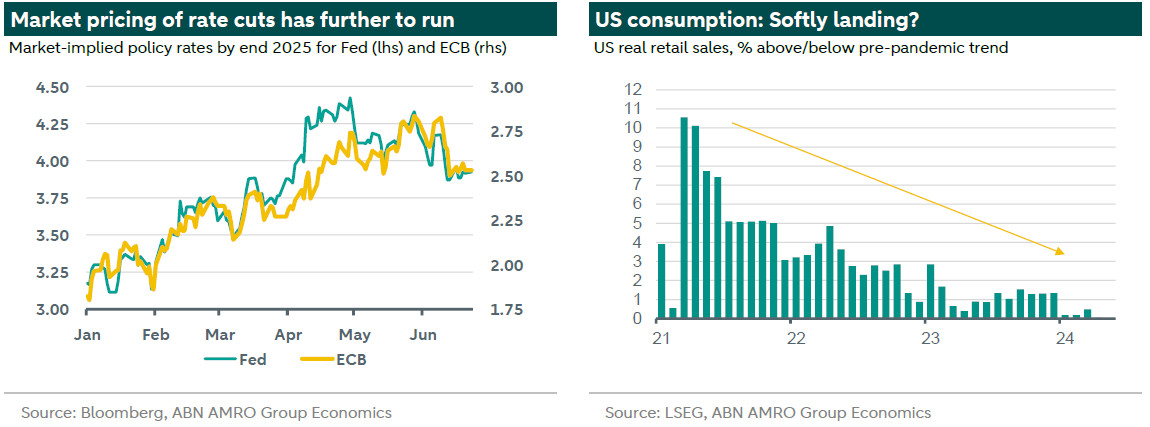

We saw a further convergence in transatlantic growth trends over the past month, although admittedly, this was driven by slowing growth in the US rather than stronger growth in the eurozone. Indeed, last week’s flash PMIs for June underlined the fact that the eurozone recovery remains fragile. Coming alongside the resumption in the disinflationary trend in the US, weaker macro data triggered trend change in market pricing for central bank rate cuts. For most of this year, markets have moved to price out rate cuts by central banks. Over the past month, that finally showed the first signs of reversing. For the Fed, markets now expect almost six rate cuts by end-2025; this time last month, they expected only four. This is still significantly short of our own expectation for nine rate cuts by end 2025. As markets gain increasing confidence in the inflation outlook, and as evidence builds that the US economy is slowing to a below trend underlying pace, we expect this repricing to continue. Meanwhile, supporting the transatlantic growth convergence will be the services recovery in the eurozone, which is benefiting from real income growth, falling rates and record tourism inflows, as well as some major cultural events that will offer support over the summer months. All of this takes place against an explosive political backdrop, with the French election paving the way for a potential showdown with financial markets and/or European institutions, while the US election campaign – and trade wars – simmer in the background. In short, there is enough to keep an eye on over the coming summer break (1). In this month’s Global View, we preview five major themes to watch.

1. Does the repricing of central bank rate cuts have further to run?

Yes.

2024 was supposed to be the summer of rate cuts. Of the major central banks in our coverage, so far the ECB is the only one to have followed through, with Fed rate cuts delayed by the unexpected rebound in US inflation earlier this year (2). As we had , US inflation is now finally springing some downside surprises, and combined with the broader cooling in US data, this supports our view that the Fed will follow the ECB in embarking on its own rate cut cycle in September. We expect inflation in the US to continue to come in on the more benign side over the coming months, and the BLS is likely to report that it will make significant downward revisions to payrolls growth data in August. However, the inflation scare of early this year means that the Fed is likely to tread more carefully initially, cutting rates only once per quarter rather than at every policy meeting. While we concur with financial markets that the Fed will cut cautiously this year, we continue to think markets are under-pricing rate cuts for next year. As things stand, markets currently only price four more rate cuts next year, while we expect seven cuts, with the upper bound of the fed funds expected to fall to 3.25% by end-2025. The summer data flow could trigger a further repricing in that direction.

For the ECB, following what practically amounted to a hawkish first rate cut in June, we expect a resumption of cuts in September. At the June press conference, Lagarde offered the hint that more guidance from the ECB would be forthcoming ‘much later in summer’. We think this is a reference to the timing of the ECB’s negotiated wage data for Q2, which comes out late July. This data point has long become a key focus for Governing Council members in judging the risks to the medium term inflation outlook. The ECB’s forward-looking tracker suggests this measure of wage growth is likely to move sideways over the coming half year or so. As such, provided this data does not show a meaningful acceleration in wage growth, we think the ECB will be comfortable enough to forge ahead with another rate cut. Supporting this view is that disinflation in the eurozone – unlike in the US – has stayed broadly on track, while suggest the recovery that started in Q1 seems to have lost some momentum. Similar to the Fed, we continue to think markets are significantly under-pricing the scope for ECB rate cuts next year.

2. Could the US slowdown get out of hand?

Most likely not.

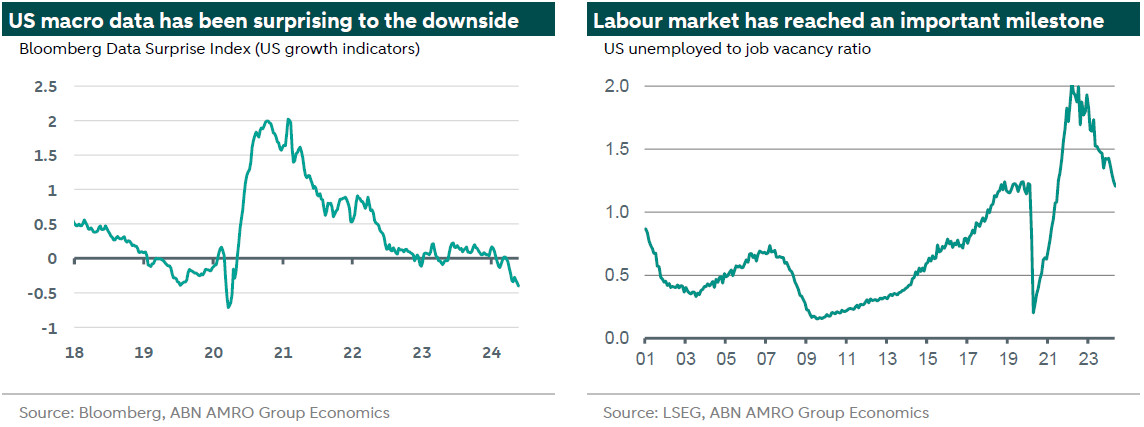

Macro data in the US has taken a notable turn southward recently, with Bloomberg’s data surprise index falling to a new post-pandemic low last week. Indeed, outside the pandemic, the index has not been this low since 2016. At the same time, as has explained, even the seemingly unstoppable jobs data might be on the verge of a significant downward revision. What is going on, and could this be the start of a more meaningful downturn in the US?

Broadly, we think the data reflects a necessary coming back down to earth for the US economy, following a prolonged period of exceptional strength, and the turn in the data is consistent with our forecast for somewhat below-trend underlying growth in the coming quarters. Consumption has normalised now that consumers have exhausted their excess savings, and supply-demand imbalances in the labour market have resolved, thanks to tight monetary policy dampening demand, and the post-pandemic surge in immigration. At the same time, the economy is likely to find a floor, thanks to: 1) strong balance sheets (household debt is still very low, despite pockets of financial stress), and 2) accommodative financial conditions (strong equity markets and low corporate bond spreads, despite high rates).

With that said, we have now reached some important milestones – particularly in the labour market – where arguably the Fed will want to be more mindful of the downside risks. The unemployment rate has risen 0.6pp from its January 2023 low of 3.4%, to 4% as of May, following a record period below 4%. Meanwhile the job vacancy to unemployed ratio has fallen sharply recently, reaching the symbolic pre-pandemic level of 1.2 in April. This still points to a strong labour market, but you would not want to see the pace of this decline persisting for much longer. All in all, the turn in the data supports our expectation for the Fed to start cutting rates sooner (September) rather than later.

3. Elections: Is the political lurch rightward unstoppable?

It looks that way, with the notable exception of the UK.

It is certainly shaping up to be a politically eventful summer. Following the earthquake of French president Macron’s unexpectedly big loss at the European Parliament election, looms the potentially even bigger aftershock of a new far right (or far left) government in France. The first round of voting in France’s snap legislative is now just days away on 30 June, and opinion polls continue to suggest Le Pen’s far right RN party is in the lead. However, the two stage process of the election (with a runoff scheduled a week later on 7 July) makes the ultimate outcome still highly uncertain. Our base case sees a minority right-wing government taking office in a cohabitation with Macron, and we think the constraints of financial markets, a lack of an absolute majority, and European institutions will ultimately contain the fiscally ambitious (to put it mildly) policy proposals. However, the election is likely to be a bumpy ride for financial markets, and it is highly uncertain to what degree the incoming government will seek to test markets and European institutions in its attempt to fulfil promises to voters. In a worst case scenario, we could end up with a UK/Liz Truss-style bout of market turmoil. See for more.

If this were not exciting enough, in the middle of the two French election rounds is the UK’s own general election, sandwiched in between on 4 July. The outcome in the UK looks much more certain and if anything quite boring, policy-wise: a moderate, market-friendly centre-left Labour government is likely to win by a landslide, following 14 years of Conservative rule under a progressively more right-wing direction. Given the UK’s lack of fiscal space, and with near-zero political appetite to make meaningful changes to Brexit policy, we see no immediate implications for UK growth, inflation, or interest rates (see Key Views for our UK macro/BoE base case). Where the election may prove more interesting is what happens to the right of the political spectrum in the election aftermath. The Conservative party is expected to suffer a historic defeat, and opinion polls show the far right, populist Reform party significantly eating into its vote share. The UK’s first past the post electoral system means that Reform is unlikely to gain many seats, but the final outcome of the election could have significant ramifications for the future of the Conservative party.

Finally, although the US presidential election does not take place for another four months, the campaign is heating up, with the first TV debate between president Biden and former president Trump taking place this week (27 June), and the second debate happening on 10 September. So far, the polls continue to paint a neck-and-neck contest, but with Trump currently enjoying a marginal lead in key swing states. We will have much more to say on the implications of the US presidential election over the coming months, but a potential re-election of Trump poses the biggest risk to the economic outlook, given his proposals for massive, large-scale import tariffs.

4. Will trade wars or the Houthis scupper the nascent manufacturing recovery?

No, but developments are worth keeping an eye on.

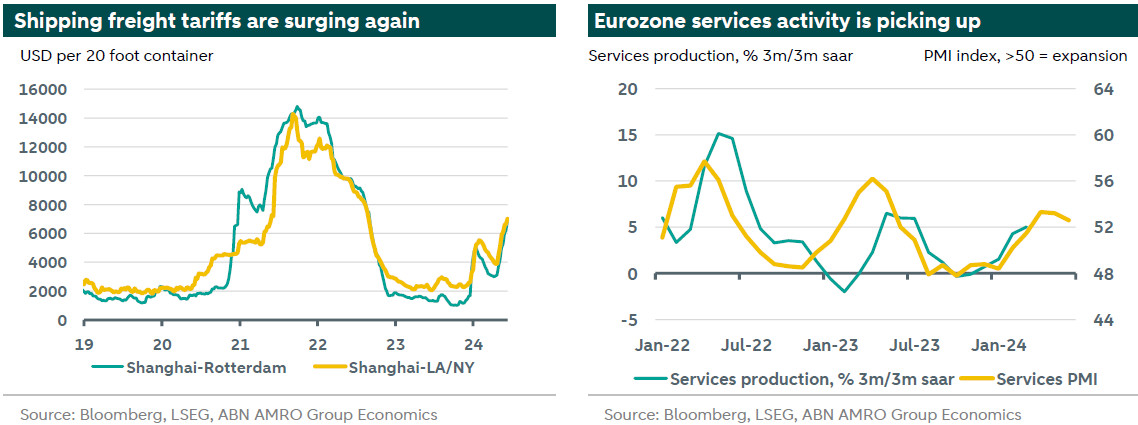

Another notable – and rather more unwelcome – recent development has been the sharp rebound in shipping freight tariffs. Tariffs spiked at the beginning of the year, after attacks by the Houthis on vessels passing through the Red Sea led to a large-scale rerouting around the longer Cape of Good Hope route. Initially, the container shipping industry appeared to have absorbed this change relatively smoothly, helped by record capacity additions. As a result, prices gradually declined from January to late April. Then, tariffs mysteriously and spontaneously began rebounding, with even shipping experts struggling to point to one particular driver. According to , the rise is being driven by a combination of factors: 1. A temporary lull in capacity additions (significant new capacity is due in the second half of 2024), 2. Somewhat stronger demand, 3. Some bringing forward of shipments due to worries about delays, 4. Port congestion in parts of Asia. There should be some easing of these pressures in the near-term, particularly as much greater capacity additions are expected (3). As we explained in our , even sustained higher shipping freight tariffs are unlikely by themselves to move the needle on inflation, given the tiny contribution shipping costs make to the final cost of a good (around 1% on average), and given that the post-pandemic falls in shipping costs had likely yet to be fully passed on (tariffs are still less than half the pre-pandemic peak). As such, even with ships continuing to avoid the Red Sea, we do not view the latest shipping tariff rises as a major risk to either the inflation nor the growth outlook, particularly as capacity additions mean that this rise is unlikely to be sustained.

Perhaps a more important development to watch is the latest trade spat between the EU and China over EVs (see China), although here too, we have seen some encouraging signs that the economic fallout will be limited. In particular, German Economy minister and vice-chancellor Robert Habeck’s visit to China has yielded an agreement from Beijing to open talks on the matter. While the Commission’s proposed tariffs on EVs are likely to be implemented in some form, the spat looks unlikely to escalate into a large scale confrontation. A much bigger risk on the trade tariff front looms from a potential Trump re-election, though that would be something to worry about in 2025.

5. What do Taylor Swift, football, and the PMIs have in common?

They all suggest that services activity in the eurozone could do rather well over the summer.

A clear bright spot in the eurozone economy over the past few months has been the services sector. Record-breaking visitor arrivals have been a particular support for activity in southern Europe, but across the eurozone, services activity has grown strongly in 2024 so far. Eurostat data shows services activity grew 5% over Q1 on an annualised basis, while the services PMI suggests that this strong pace of growth carried over into Q2, and probably will continue in Q3.

Aside from rising real incomes, and the gradual fall in interest rates expected over the next few months, another positive driver of services activity is the number of major sporting and cultural events in the eurozone this summer. The European football Championship has already kicked off in Germany, and over the coming weeks an suggests that extra visitor spending on hospitality could add 0.1pp to GDP growth in Germany in Q3. GDP in France could see an even bigger boost from the Paris Olympics – following a similar methodology to Ifo’s analysis for Germany, we estimate it could add 0.2pp to French Q3 output. While suggesting some near-term upside risks to growth forecasts, it should be noted that these boosts to activity are very much one-offs, and will therefore probably be subject to payback in Q4 as the effects unwind.

Finally, we must not ignore the Taylor Swift effect – if not on activity then perhaps on inflation. After Beyonce concerts famously boosted Swedish inflation last year via a jump in hotel rates, Swift’s concerts apparently had a similar upward impact on Sweden’s inflation rate for May. According to analytics firm , hotel rates are expected to jump on average 44% in periods when Swift performs. It should be noted that such events by themselves are far less likely to boost overall eurozone inflation given that the eurozone is many multiples the size of Sweden. However, they could impact the inflation rates of individual countries, and coming alongside the major sporting events happening over the same period (Swift’s concerts take place across Europe between May and August), there could well be some modest upside risk to services inflation forecasts over the summer period. But, as with the boost to activity, any temporary effects will surely see payback later in the year.

In conclusion, the main impact of these big summer events will likely be to inject unwelcome volatility to the data rather than provide any meaningful economic signal.

(1) As is customary over the summer, we will take a break in July, resuming publication in late August.

(2) For the Bank of England, we have long been of the view that rate cuts would start in August and proceed at a slower pace than the Fed and ECB, given that inflation is likely to prove stickier in the UK than in the US and the eurozone

(3) 1mn teu of new container capacity has been added so far this year, fulfilling the extra demand associated with longer shipping routes, but another 2mn is expected to be added by the end of 2024 and this should lead to a net expansion in capacity rather than only making up for the shipping diversion. This is explained .