Fed Watch - Update on our Fed view

Now that the dust from the financial market turmoil around the weekend has settled a bit, we can have a clearer view on what recent events imply for the Fed rate path. Inflation is coming down in line with expectations, but headline labour market figures are deteriorating at a more rapid pace than initially expected. The deteriorating labour market increases the urgency to cut, and the resulting decrease in wage pressures allows the Fed to be less cautious. We therefore remove the two pauses from our base case Fed path. We now expect a 25bp cut in every meeting until the upper rate reaches 3.00% in November 2025. Given currently available data, we do not yet see a reason for an initial 50bp cut.

At the time of our previous update to the Fed view, back in June, our projected path was significantly more dovish than the market was pricing. This update on the other hand is significantly more hawkish, with a slower path to neutral. We think the overall macro outlook is simply not so bad as to warrant a rapid easing cycle. As outlined in our recent note, we believe risks of a recession are generally contained. Growth and demand for Q2 were still very strong and recent inflation readings have been benign. The labour market is starting to show some weakness, but we believe the headline unemployment rate is overstating the deterioration in the labour market because of still elevated supply stemming from immigration. Previous episodes where the unemployment rate showed a similar rising path were generally driven by an actual decrease in labour demand. This time, the decrease in labour demand is more gradual compared to historical patterns.

For financial markets, September is still far away. There are a number of key events between now and the next FOMC meeting. We get two more CPI inflation readings for July and August, and consumption and labour market data for July. All but the August inflation release will be available to Chair Powell when he makes his speech at Jackson Hole at the end of August, which he will certainly use to steer market pricing in line with his expected September move. Two days before that speech, the Bureau of Labor Statistics will provide a glimpse of so-called QCEW data which will be used to officially adjust non-farm payrolls early next year. We think these will point to a downward revision of the non-farm payroll data. This will not come as a surprise to the Fed, but may lead to some volatility before Powell will attempt to calm markets at Jackson Hole.

Why not 50bp?

The overall risk to the Fed path is certainly on the upside. It is unlikely that the inflation readings will be so high as to keep rates steady. Rather, a worrisome labour reading may push the Fed to immediately cut by 50bp to accelerate the path to neutral. If the data comes in line with our expectations, the 25bp cut would probably be most appropriate. In such a scenario, a 50bp cut might actually worry markets more, seeing an urgency at the Fed after merely calling the developments in the labour market a ‘normalization’ in July. A high initial cut also sets expectations for the speed of rate cuts in the remainder of the path, which would have to be carefully managed.

What does the changed Fed view mean for bond yields?

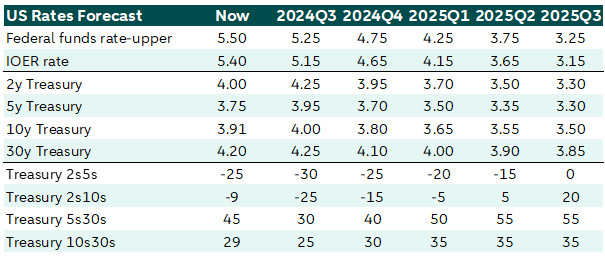

Following the changes in our Fed view and the recent market movements, we have revised our forecasts for US Treasury yields. Our revisions are based on the expectation of two additional rate cuts of 25bp in our base case, leading to lower US Treasury yields than previously projected. However, it's important to note that these revised yields still remain higher than current levels.

In recent days, the market has reflected expectations of multiple rate cuts this year (as mentioned in our previous comment here), causing Treasury yield levels to trade at (too) low levels in our view. The market is currently pricing in approximately 50 basis points more rate cuts than our base. This shift is illustrated by the graph below, highlighting an anticipated extensive rate cut cycle as market focus turned from inflation risk to recession risk. Based on our macro outlook discussed above, we believe that the market has prematurely adjusted its expectations for rate cuts in the upcoming FOMC meetings and should start to reprice it out again as the economic data proves more resilient than the market is currently anticipating.

In summary, the recent changes have primarily impacted the front-end of the yield curve, particularly the 2-year and 5-year bond yields due to their close ties to near-term monetary policy. As a result of market expectations for additional rate cuts, we anticipate a (bull)steepening in the Treasury yield curve at a faster pace than previously forecasted.

However, it's important to note that until the market adjusts its expectations for excessive rate cuts this year, our stance on duration remains neutral. We expect heightened volatility in US rates in the coming weeks and anticipate upward pressure on yields until market pricing aligns more closely with our Fed policy rate path. Therefore, we expect the Treasury yield curve to flatten in the near-term before steepening again later in the year.