Fed raises interest rates and signals much steeper rises to come

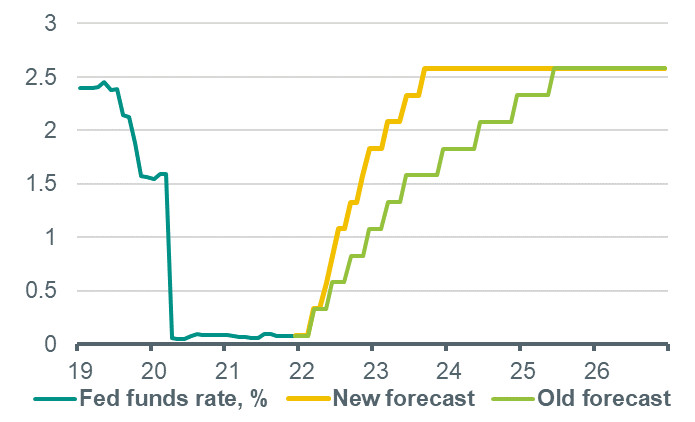

The Fed raised interest rates for the first time since 2018. In addition, it signalled a total of seven rate hikes this year, and a further four rate hikes next year, which would take the fed funds rate to 2.8%. In the press conference, Chair Powell emphasised that the overriding priority of the Fed is price stability, suggesting rates would continue rising even if growth significantly weakens or unemployment starts rising.

As widely expected, the Fed raised the target range for the fed funds rate by 25bp yesterday, to 0.25-50% – the first rise in rates since 2018. In addition, the Fed signalled a much steeper path for the fed funds rate over the coming two years, with the median FOMC member now expecting a total of seven rate hikes this year, and a further four rate hikes next year. While this brings the Fed’s projections much closer to , we did not expect the Committee to signal quite such an aggressive path for rates at this stage, which points to the fed funds rate rising to 2.8%, around 30bp above the estimate of neutral (2.5%) by next year. Indeed, the new projections appeared to surprise financial markets, with Treasury yields initially jumping around 6bp following their publication. Alongside new rates projections, the Committee made a significant downgrade to its 2022 growth forecast relative to December projections, to 2.8% from 4.0% (Q4/Q4), which Chair Powell attributed largely to the impact of the Russia-Ukraine conflict (this is at the weak end of , although it probably incorporates some backward-looking downward revisions as well). The Committee also made another major upgrade to its PCE inflation forecast, to 4.3% from 2.6%, and signalled increased concern about the medium term inflation outlook by also raising forecasts for 2023 (+0.4pp to 2.7%) and 2024 (+0.2% to 2.3%).

Price stability is the overriding policy priority right now

In the press conference, Chair Powell largely reiterated views expressed at his recent testimony to Congress. Most notable for us was the continued emphasis on the importance of achieving price stability as a pre-requisite for sustained strength in the economy and the labour market. Indeed, when directly asked if the Fed would still want to continue raising rates even in an environment where the unemployment rate is rising, Powell said “price stability is a pre-condition for achieving the kind of labour market we want.” In addition, while acknowledging the significant tightening in financial conditions we have seen since the outbreak of the Russia-Ukraine conflict, he appeared to endorse a further tightening in financial conditions by stating that he expected conditions to continue to incorporate the ongoing rate rises by the Fed. All of this is consistent with our view that the bar is much higher for the Fed to pause or slow down its policy tightening in the face of a weaker (perhaps even recession-like) growth environment or much tighter financial conditions, given the scale of the inflation problem in the US and the prioritisation the Fed is giving to returning inflation back to target.

Finally, on the balance sheet, the Fed did not publish additional details at this meeting as Chair Powell had previously indicated. However, Powell did say that the details of the unwind were now ‘being finalised’, that the parameters of the plan should be ‘familiar’ – in reference to the 2017-18 quantitative tightening episode – and that an announcement could come as soon as the next meeting. We judge this signalling as consistent with our expectation for a May start to the balance sheet runoff, with monthly caps on bonds not re-invested initially set at $15bn per month, and this gradually rising to a maximum pace of $100bn per month by September. Powell suggested that the tightening of policy via the balance sheet runoff would be the equivalent of around one extra rate hike. We continue to see a risk that the Fed engages in outright sales of Treasury securities as part of the runoff process, provided market conditions are conducive to this.