Russia - Ukraine: Sanctions to trigger a lasting trade re-alignment

Following the news yesterday of an official US and UK embargo on Russian oil imports, the EU's announcement to cut 2/3rds of Russian gas imports within a year, and ‘self-sanctioning’ moves by major oil and gas (and many other) companies, we have revised our scenarios describing how the Russia-Ukraine conflict will impact the European and US economies over the coming quarters. We now expect sanctions to lead to a lasting global trade re-alignment, with dependence on Russian energy and other commodities gradually – potentially more abruptly – reduced, and replaced with alternative sources. Even in the most optimistic de-escalation scenario, we cannot foresee a return to the situation of two weeks ago.

This is due to the withdrawal of western oil and gas companies from Russia and the knock-on effects this vacuum in technical expertise will have for future supplies. It is also highly unlikely the conditions for removing sanctions (which have not been specified) would be met even in a de-escalation scenario. The question then becomes how long this structural trade re-alignment takes, and how disruptive for economies it will be.

Given the ongoing fluidity in developments, we refrain from making explicit forecast adjustments today, and here describe in broad terms the macro-economic effects of each scenario. We hope to communicate forecast changes as soon as there is greater clarity on the outlook.

New base case – Energy and commodity supply shock lasting one year

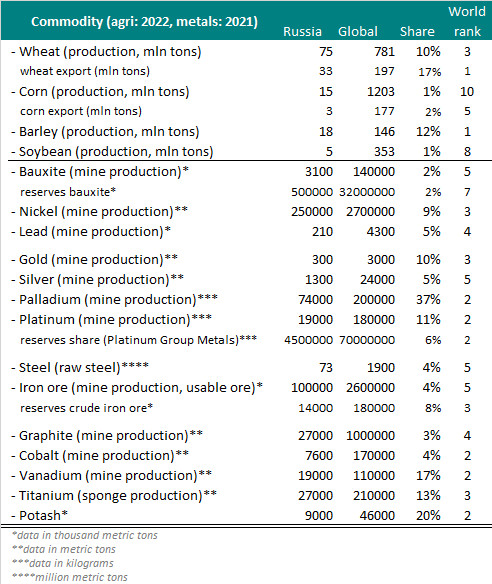

In , our base case revolved around a price shock, but did not include disruptions to physical supplies of energy and commodities, which are much more economically damaging. Our new base case acknowledges that physical supply disruptions are already happening, and we now see these disruptions getting worse over the coming months as embargoes and self-sanctioning moves come into effect. This will have knock-on effects on supply chains, and there is also the potential for retaliatory moves by the Russian government (it has already announced an intent to ban the export of certain commodities, with the details yet to be announced). Energy prices (including electricity) will remain elevated in this scenario, alongside metals and agricultural commodities, with goods inflation therefore spiking further. Price spikes will induce self-rationing of supplies, leading to industry disruptions, while the hit to household purchasing power will weigh on confidence and private consumption. The significant tightening in financial conditions we have seen (largely equity market falls) will also weigh on confidence and activity. Note, we do not assume a complete cut-off in Russian oil and gas supplies to Europe in this scenario – this is something we reserve for a more negative scenario outlined below.

Russia is a significant global supplier of commodities, not just energy

The eurozone and UK economies will continue to be much more negatively affected than the US economy in our base case. Inflation will be 1.5-2pp higher than our current projections, while GDP is likely to 1-1.5pp lower. We expect governments to step in to stem the macro-economic fallout, for instance through price caps or compensation to households and industry, but governments will struggle to offset the inevitable disruptions to physical supplies. Already, some car plants have had to pause production, for instance, due to lack of cabling supplies from Ukraine. We expect these types of disruptions to intensify over the coming months. All told, we expect the eurozone and UK economies to avoid a technical recession, as even in this new environment there is still room for recovery after the pandemic, but growth will be significantly lower.

At the same time, high inflation significantly limits what monetary policy can do to offset the impact. While a delay to ECB tightening and potentially a continuation of asset purchases is looking more likely, we do not foresee a significant easing in policy of the kind we witnessed during the pandemic. For the Fed, given that the US economy will be facing higher inflation but less of a growth hit (as it is much less dependent on Russian commodity imports), the calculus shifts even more in favour of rate hikes. We are currently reviewing our base case for both the ECB and the Fed, and plan to communicate on this in the coming days.

In our new base case, we assume this period of very elevated prices and supply disruptions will last around one year, as new sources of non-Russian commodity supplies are secured and global trade flows re-adjust. However, even once supply disruptions ease, prices are likely to remain elevated thereafter, and this will continue to weigh on economic activity.

Negative scenario – Supply disruptions last up to two years (significant probability)

In this scenario, we assume an abrupt, complete shut-off of Russian oil, gas and other commodities to Europe, with disruptions to supplies taking much longer to resolve – perhaps up to two years. The impact of a gas cut-off is particularly negative, due to its reliance on physical (pipeline) infrastructure, and the lack of LNG terminal capacity to replace Russian supply in the near term. However, it will also be challenging to source other commodities from elsewhere at short notice, especially given the challenges in global shipping, which will be put under even more pressure in this scenario. In addition, we would expect a further significant tightening of financial conditions, on top of the tightening we have already seen, chiefly on the back of equity market falls. The negative macro-economic effects will therefore be amplified, with more widespread and persistent industry stoppages, and explicit government rationing of energy supplies to prioritise households and critical industries. This scenario would lead to even higher inflation, and trigger technical recessions in the eurozone and UK economies. The US would see a growth hit of 2-3pp as even it would not be immune to knock-on supply chain disruptions in this scenario, while price spikes would weigh heavily on consumer confidence and consumption.

While governments will likely implement further support measures to cushion the blow in this scenario, central banks would continue to be constrained by high inflation in their ability to provide support to the economy. We expect the ECB to step up asset purchases, especially if spreads on peripheral eurozone sovereign debt widen significantly, but for the US, we would only expect some modest slowing in the pace of rate hikes, given the risks around inflation and the more modest hit to growth.

Positive scenario – More rapid trade re-alignment, disruptions lasting 6 months (very low probability)

We ascribe only a low probability to this scenario, which assumes a quicker realignment of global trade flows, shortening the disruption to energy and other supplies to around 6 months. The US and perhaps some OPEC countries could raise oil output in order to fill the gap left by Russia, and/or Russian oil is bought by eg. China, freeing non-Russian supply to go to Europe. The same could apply to other commodities. This would depend crucially on sufficient shipping capacity being available. In this scenario, negative macro effects are less pronounced, with only limited industry stoppages. Growth would quickly rebound once supply disruptions ease. However, inflation would remain elevated on the back of continued high commodity and goods prices.

The scenarios in pdf:

And the same in table below we summarise our new scenarios.