US - Landing softly – so far

Softening demand, and easing supply bottlenecks, suggest the economy is gradually cooling off. Even so, the labour market remains exceptionally tight, meaning the Fed’s job is not yet done. We expect the fed funds rate upper bound to hit 4.5% by December, but still expect rate cuts in 2023.

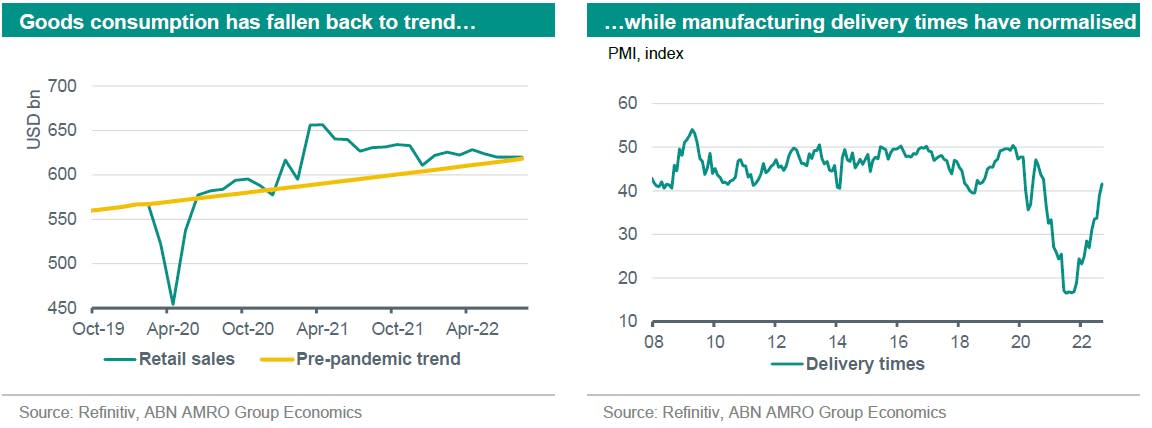

The overheated US economy is gradually cooling off. Goods consumption was largely stagnant in real terms over July-August, and we estimate that it is now basically back at trend – following nearly two years of well above trend demand. This comes against a backdrop of an easing in most supply-side bottlenecks, with PMI delivery times now back to normal, and pipeline cost pressures easing – both materials and logistical services cost growth has come down. At the same time, the cooling in the economy has not been disorderly, at least so far – despite the abrupt U-turn in monetary policy early this year. While the composite PMI plunged in August, the September flash reading – though still weak – was a big improvement, and suggested that the August data were an anomaly. The US economy is, in short, achieving a largely soft landing in our view.

All of this by no means suggests the Fed’s inflation-fighting job is done. Indeed, the August inflation data surprised market expectations to the upside, with falling petrol prices offset by a rebound in goods inflation, and a continued firming in housing rents. We expect core services inflation – particularly housing and medical – to remain strong over the coming year. However, overall inflation is likely to cool down, as the various easing pipeline pressures (lower commodity prices, the strong dollar, easing bottlenecks) meet stagnant consumer demand. The main upside risk to the inflation outlook continues to come from the labour market. The August payrolls report suggested some modest improvement, with a rise in participation helping to nudge the unemployment rate a little higher, to 3.7% from 3.5% in July. Wage growth also eased a touch, although it remains well above levels consistent with the Fed achieving its 2% inflation target. Strong wage growth is being driven to a large extent by excess labour demand – job vacancies remain far too high relative to the number of job seekers. As such, the labour market is still a long way from where the Fed needs it to be comfortable with the inflation outlook.

Indeed, the Fed tilted further in a hawkish direction at the September FOMC meeting, with the upper bound of the fed funds rate projected to reach 4.5% by the end of the year. The projections also showed policy staying restrictive throughout the forecast horizon, with no rate cuts seen until 2024, and policy still above neutral even in 2025. Despite this, we continue to think the Fed is likely to modestly cut rates in H2 2023. We expect a steeper rise in unemployment than the FOMC projects, to c.5% by end-2023. Given the lags with which monetary policy affects the economy – the labour market being the last domino to fall – we think the Fed will be confident that the economy is cooling sufficiently by the middle of next year. As such, we continue to expect around 100bp in rate cuts in H2 2023, although the higher level from which the Fed would be cutting means we are now likely to end 2023 at 3.5% in the upper bound of the fed funds rate, up from our previous 3% expectation. In the near term, the risks to policy continue to be to the upside, with more tightening necessary if the labour market does not cool in line with our forecasts. However, the tighter policy stance than we previously expected also raises the risk of a deeper downturn further out, and potentially larger rate cuts if inflation also moves more quickly back to target.