Oil market update - Market prospects in 2025

OPEC+ has once again postponed its plan for the revival of its production until January. The outlook for next year is widely seen to be negative with the main international agencies expecting a surplus even if OPEC+ does not step up production as supply additions outpace demand growth. Under the new Trump administration, we expect an increase in oil supply and further slowdown in demand following the proposed reduction in taxes and protective trade measures. We expect significant downside for oil prices over the next year. In the first half of the year, frontloading in demand starts to bring the market into better balance reducing some pressure on prices, though we expect Brent to head towards USD 60 by year end.

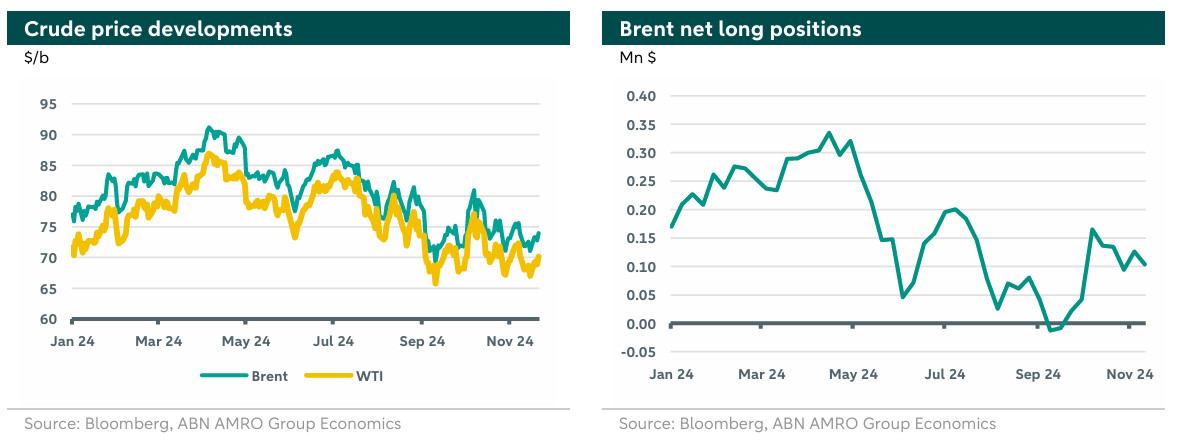

After a dip in September, oil prices witnessed a temporary rise in October which was mainly driven by escalations in the Middle East. However, as the latest Israeli attack did not target Iranian nuclear or energy facilities, the geopolitical premium reached its lowest levels in months, pushing prices down again. The lack of conviction in China’s fiscal stimulus and the Republican sweep in the US have also put downward pressure on prices, with the trend also supported by the strengthening of the dollar. However, in the last few days, renewed escalation in Ukraine pushed up prices. The outlook for next year is widely seen to be negative with the main international agencies expecting a surplus even if OPEC+ does not step up production as supply additions outpace demand growth. The surplus is mainly driven by the weak growth of the Chinese economy and the increase in the supply by non-OPEC countries, along with the depressive impacts of the potential tariffs under the new US administration. Brent prices were trading around 75 $/b at the time of writing.

Oil market developments

OPEC+ has once again postponed its plan for the revival of its production for one month, towards January 2025. The cartel and its allies have indicated that their decision could still change in their meeting early December. The cartel announced in June the phase out of their voluntary cuts that aim to put 2.2 million barrels of oil back into the market over the period of a year starting in October 2024. However, due to adverse market conditions, especially the slower than expected Chinese demand, and the increase in supply of Non-OPEC+ members, they decided to postpone these plans for two months and now for an additional month. Currently, OPEC+ spare capacity amounts to more than 5 million barrels a day. On a related note, Iraq reduced its production last month, but it is still above its agreed quota, while Libyan output is back to normal levels after decreasing for several months, as the political crisis in the country unfolded. Kazakhstan is also still struggling to meet their agreed quota commitments within OPEC+.

The IEA adjusted its expectations for oil demand growth in 2025 downwards by 0.01 mb/d, compared to last month. The IEA cites high adoption rate and the proliferation of electric vehicles in China and advanced economies, along with slow growth of the Chinese economy as key drivers for its outlook for low demand growth (0.99 mb/d, y-o-y). Other institutions, such as the EIA and OPEC also adjusted their outlook as they anticipate lower demand growth compared to their initial forecasts earlier this year (OPEC revised global oil demand growth down by 103 tb/d from the previous month’s assessment to 1.5 mb/d, y-o-y), but the gap between IEA and OPEC forecasts remains substantial around 0.5 mb/d. All agencies share the view that supply from non-OPEC+ countries would keep rising in 2025. More supply is especially expected from the US, Guyana, Canada, Brazil, and Norway. All in all, forecasts of main agencies indicate a surplus in 2025 as supply additions outpace demand growth, putting downward pressure on prices.

We note here that current price levels (around 72 $/b for Brent) are considered low for Saudi Arabia which, according to the IMF, would need a price of 100 $/b to finance the ambitious 2030 vision of crown prince Mohammad Bin Salman. However, a price-war scenario by OPEC+ in 2025 to regain market shares is improbable given the adverse impact on the cartel members themselves, and the healthy financial position of non-OPEC+ oil producers who generally enjoy strong balance sheets, making them more resilient to any shocks that could originate from higher supply by OPEC+.

Furthermore, the geopolitical premium has reached its lowest level in months as most of the fears of supply disruptions eased following a perceived de-escalation of geopolitical tensions in the Middle-East since the latest Israeli attack on Iran did not target nuclear or energy facilities. We note that the idle OPEC+ capacity would provide a buffer for future geopolitical escalations, mitigating the volatility in the market. This was evident with the latest market reaction to the escalation between Russia and Ukraine where Brent added a premium of around 3 $/b.

The impact of Trump win on oil markets

During his campaign, President Trump was outspoken about his support for the oil and gas industry. Thus, in his second presidency we expect to witness further increase in US supply by easing regulation and lower taxes (President Trump vowed to reduce corporate tax from 21% to 16%), which would strengthen further the financial status and competitiveness of the US oil producers. Furthermore, the envisioned protective trade policies under the new administration would likely affect oil demand negatively. In particular, Trump could opt for a universal tariff between 10-20% on all goods (with even 60% tariff proposal for China). Although our macroeconomists are assuming a more moderate and gradual implementation of tariffs, the rise in the average rate would still be significant. Tariffs would affect oil demand through several channels. We would see lower industrial production and trade more generally. They would hit China particularly hard and we note that China is the leading importer of oil worldwide with almost 24.8% of imported crude oil in 2023. In addition, there would be impact on the speed of the transition, especially the rollout of electric vehicles (EV). Tariffs would increase EV prices in the main economies and reduce their adoption rate, which in turn keeps oil demand for transportation purposes higher for longer. Still, we think that the former impact will dominate any upward pressure from slower rollout of EVs.

We lay down our expectations for US tariffs in detail in our global outlook for 2025 (see more here), where we argue that tariffs will have a temporarily positive effect on growth in the eurozone and China, as US importers frontload purchases to avoid higher tariffs (for the US the frontloading will have the opposite impact on economic growth). Combined with the recovery in domestic demand, this is likely to lift growth in early 2025. However, this impact will be short-lived, with exports likely to see a sharp decline immediately after tariffs are implemented, with trade later settling at its post-tariff new normal, affecting expected growth rates adversely for all trading partners but the timing of this impact will differ along 2025 for each party. The negative impact on the economy will be deeper with higher level of implemented tariffs. Furthermore, the tariffs will induce a divergence in interest rates across the Atlantic. Accordingly, oil demand could benefit initially from a frontloading positive impact of the tariffs, which would partly offset the excessiveness in supply, but later in 2025 these tariffs would depress demand even further.

Outlook

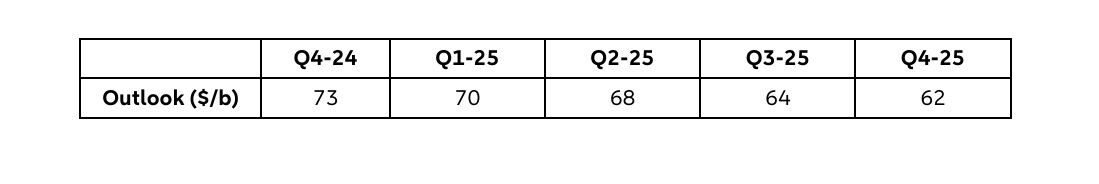

We foresee the oil market to be in a surplus in 2025, even if OPEC+ decide not to go ahead with higher production. This is given the lackluster global demand and the strong supply form non-OPEC+ countries, which is expected to increase even further under the new US administration. We also think that the scenario of a price-war is improbable, while the idle OPEC+ capacity would provide a buffer that offset any supply disruptions originating from geopolitical escalations. Demand growth is expected to slowdown in general, and even further under new Republican administration, which will likely implement much higher tariffs on US imports, especially from China. However, oil demand could benefit initially from a frontloading positive impact of the tariffs, but later in 2025, these tariffs would depress demand even further. Accordingly, we hold our outlook for Brent to average 73 $/b in Q4 of 2024. We revisit our outlook for 2025 downwards, where we anticipate Brent prices to remain around 70 $/b in the first half of the year as the recovery/frontloading in demand starts to bring the market into better balance before weakening much more significantly by the year end driven by the US tariffs. Below is a summary of our Brent outlook.