Eurozone - Trump tariffs push ECB beyond neutral

The recovery is continuing for now, with growth to average 0.8% in 2024, and 1.2% in 2025, but the economy is likely to slow later in 2025 on new US tariffs, to 0.1-0.2% q/q. Domestic demand increasingly picking up the growth baton; consumers benefit from real income gains. Labour demand in the eurozone is softening, but the overall labour market remains resilient. The eurozone fiscal stance is neutral in 2025, but France faces significant fiscal tightening. Disinflation remains on track; tariffs lead to inflation persistently below target inflation in 2026. This prompts the ECB to extend its rate cut cycle to a low of 1% in 2026.

Growth to remain sluggish, tariffs to constitute a new headwind from H2 2025 onwards

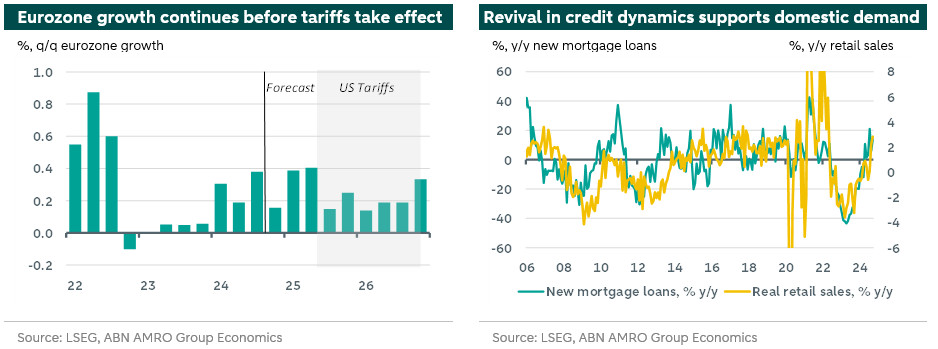

After a prolonged period of stagnation, the eurozone economy returned to growth in 2024. While the recovery has remained subdued, we expect growth to continue at roughly the current pace on the back of improving domestic demand. Quarterly growth is expected to slow in Q4 to 0.2% q/q following 0.4% in Q3, weighed by payback following the French Olympics, and the floods in Spain. Moving into 2025, growth should pick back up due to ‘frontloading’ effects, i.e. US firms increasing imports from the EZ in anticipation of tariffs. The implementation of these US import tariffs adds a significant new headwind for eurozone growth (see here). From H2 25 onwards, lower exports to the US will constitute a drag on growth, slowing the overall growth profile.

The subdued eurozone recovery gets impulse from domestic demand

In H1 2024 domestic demand was a drag on activity, but is now finally becoming a source of growth. Despite lower inflation and high wage growth driving real incomes gains, consumers preferred deleveraging and saving over consuming. Policy uncertainty, and conflicts in the Middle East and Ukraine may have caused consumers to adopt a wait-and-see approach, and prompted businesses to delay investments. More recently, in part due to the first effects of rate cuts feeding through to for instance housing markets, consumers seem to have found their wallets (see chart above-right, and our September Global Monthly). Indeed, solid Q3 GDP growth likely already reflected an expansion of household consumption, as signalled by monthly retail sales data. Stronger demand for goods and further rate cuts feeding through to the economy also bodes well for the struggling eurozone industrial sector. Although the industrial sector is not anticipated to drive growth in 2025, rising domestic demand should help to stabilise activity. The rebound in investment likely needs a bit longer to ramp up, especially with rates still restrictive and current industrial activity still weak. Recovery and Resilience fund (RRF) flows will however continue to drive public investment activity (see below). All in all, considering the further expected increases in purchasing power in 2025 (alongside rate cuts), and the uncertain external demand environment, domestic demand is likely to be the main growth driver in 2025 and 2026.

Eurozone fiscal stance neutral in 2025, with France facing a significantly contracting fiscal stance

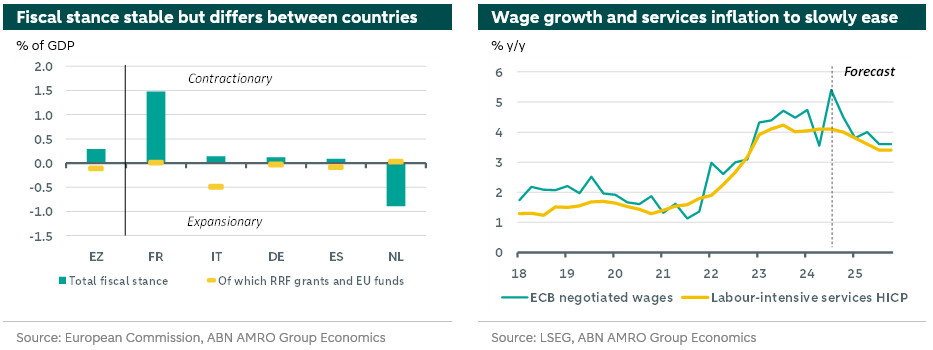

In 2024 the eurozone fiscal stance has been slightly contractionary. In 2025, the fiscal stance switches to neutral. While many governments are taking fiscal consolidation measures in national budgets, this is offset by increased RRF grants and EU fund flows (including the diversion of unspent cohesion funds to defence spending). The neutral fiscal stance of the eurozone aggregate hides significant differences between countries. France will see a significantly contractionary fiscal stance of roughly 1.5% of GDP, consistent with the expected fall in the budget deficit in 2025. Other large economies such as Germany, Italy and Spain have broadly neutral fiscal stances – in line with the aggregate – while the Netherlands an outlier in the opposite direction, with a highly expansionary fiscal stance of around 1% of GDP in 2025. A shift could happen in Germany, with the government collapsing due to disagreement on reforming the strict debt brake rules, and a potential new coalition might step up much needed public investment (see here). Overall, the neutral fiscal stance in the eurozone in 2025 is more supportive of growth, relative to the contractionary stance in 2024, but the significant regional variation naturally has implications for growth differences. This year, peripheral countries – especially Spain – outperformed core countries such as France and Germany, helped by strong tourism activity and services demand as well as past Recovery and Resilience fund payouts (RRF). Looking forward however, this gap may narrow somewhat, primarily due to growth in Germany edging up from the weak 2024 (see here). However, lower growth in France, partly due to the highly contractionary fiscal stance, will partly offset this.

Disinflation on track, undershooting 2% later on due to tariffs

Over the course of 2024 the disinflationary process has made considerable progress. Headline inflation declined from 2.8% at the start of the year to 2% in October and core inflation declined from 3.3% to 2.7%. One area where disinflation has covered less terrain is services inflation, which remains elevated at 3.9% as of October. As a key indicator for domestic inflationary pressure, this remains the main worry of the ECB. Due to the high share of labour costs in total costs, services inflation is heavily influenced by wage developments. As a result, services inflation is expected to pick up again in the short run, due to past and present high negotiated wage growth, and is only expected to decline slowly over the course of 2025. Over time, wage growth is expected to ease, given that workers have largely recouped past purchasing power losses, and the eurozone labour market is loosening as the pace of employment growth slows. Falling negotiated wage growth is also consistent with leading indicators such as the Indeed tracker. Still, the eurozone labour market is expected to remain resilient. As such, disinflation in services will likely continue to proceed slowly in 2025. Despite this, falling energy prices (especially oil) will likely drive headline inflation back to 2% in the first half of 2025. In 2026, new headwinds from our US tariff scenario on economic growth will have a profound impact on inflation, directly via energy prices and indirectly via macro-economic slack. This will more than offset any upward pressure from European retaliatory tariffs, pushing inflation substantially below the 2% target.

ECB to tread carefully around neutral, but go beyond neutral in H2 2025

The ECB commenced rate cuts in June, and with three rate cuts in H2 2024, the easing cycle is now well underway. Taking into account the expected trajectory of inflation, the central bank is expected to cut rates by 25bp at every meeting until the second quarter of 2025. At the April meeting, we see the ECB pausing for two reasons. First, by then the deposit rate will stand at 2.5%, getting closer to the ECB’s own estimate of neutral of around 2%. Approaching neutral, the ECB is likely to once again follow a more data dependent approach, especially as overall growth is expected to be firm in the first half of 2025 due to ‘frontloading’ effects following the announcement of Trump tariffs. Secondly, the potential Trump tariffs alone are a reason to adopt a wait-and-see approach. In our scenario we expect US tariffs to be announced in Q2 25 and implemented from Q3 25 onwards. We think the ECB will want to tread more carefully in this phase, as it assesses the impact of the tariffs on eurozone growth and inflation. We expect both to fall on the back of US tariffs, but it is the growth shock that we think will be most concerning to the Governing Council. This is consistent with recent communication from the ECB on the risks weaker activity poses to the inflation outlook. Ultimately, we expect the ECB to resume rate cuts in June, and to cut rates by somewhat more than markets currently price, at each consecutive meeting until the deposit rate reaches 1% in early 2026. In doing so, roughly a year from now the ECB will have moved from a restrictive to an accommodative stance of monetary policy, which should help to some extent in putting a floor under the growth shock from US tariffs.