ESG Economist - A losing battle to meet car emission reduction goals

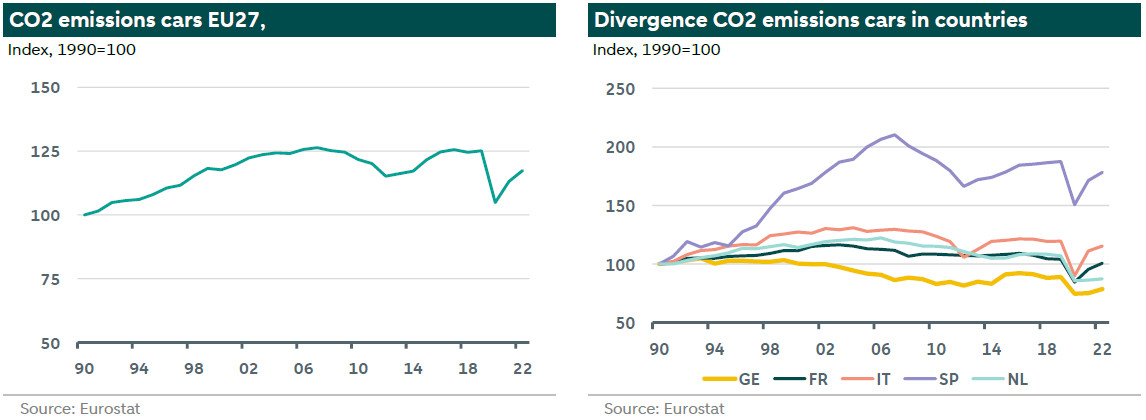

According to Eurostat, the EU emitted 2,857 Megaton of CO2 in 2022 and the transport sector accounted for 28% of that total or 794 Megaton and cars accounted for 447 Megaton (Mt) or 56% of transport representing 16% of all EU27 CO2 emissions. EU27 CO2-emissions were down by 28% at the end of 2022 compared to their 1990 levels. However, this downward trend in emissions is not visible in emissions from transport, which are 20% higher including a 17% increase from cars compared to 1990 levels. On a country level, emission trends differ significantly. CO2 emissions by cars have substantially increased in Spain (+78%) and Italy (+15%), while they have considerably decreased in Germany (-22%) and the Netherlands (-13%). For the Netherlands emission data are already published for 2023. Unfortunately, the downward trend did not continue in 2023. Indeed, according to the CBS data emissions from cars in the Netherlands increased again in 2023. Taken all together the emission trend in cars for the EU is not moving in the right direction. In this report we try to answer the following questions. How many cars are there on the road, what kind of car is it (battery electric, petrol, diesel etc) and what is the CO2 emission intensity of the fleet? What is the current policy and projected emissions path for the EU? What is the EC proposal for period after 2030? What are the policies for Germany, France, Spain, Italy and the Netherlands? Finally are we able to reach the emission reduction targets?

EU27 CO2 emissions are on a declining trend versus 1990 except for transport (including cars)

CO2 emissions in cars for EU27 are 17% above their 1990 levels

The EU has set ambitious targets to bring down emissions including for cars

The only way to reduce emissions is to increase the share of zero emission cars in the fleet

After a substantial increase in demand for EV from very low levels, EV sales are declining

Zero emission cars represent only a very small share of the total fleet (1.2% in 2022) and incentives to buy these cars are being reduced

To keep some hope of limiting global warming to 1.5°, emissions need to be reduced substantially in the coming years otherwise emissions will exceed the related carbon budget

So there is a need for more incentives and not less if governments are to achieve their car climate goals

How many zero emission cars are on the road?

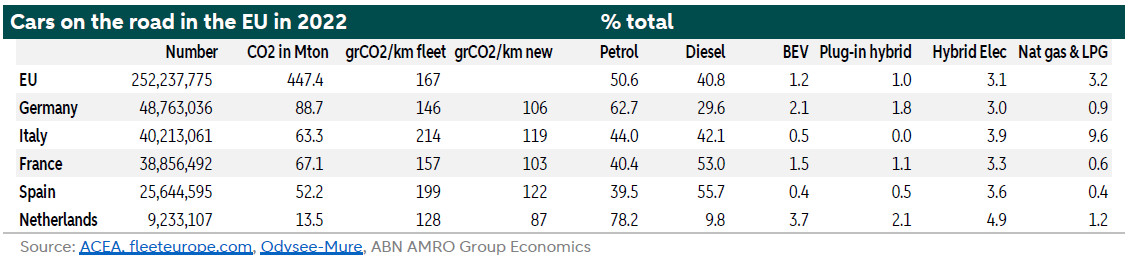

In 2022 there were 252 million cars on the road in the EU with an average age of 12.3 years and around 95% of these cars burnt fossil fuels. Only 1.2% of the 252 million cars were battery electric. The table below shows the specifics by country. For example, Germany has most cars on the road (mainly petrol cars) and the Netherlands has the lowest CO2 intensity and the highest share of the battery electric vehicles on the road in 2022 (at 3.7%). This percentage had increased to 5.6% by August 2024 according to the RVO.

Emission intensity

The countries with high emissions are also large countries with more cars on the road. Therefore, the emission intensity of CO2 grams per km of the cars on the road in these countries is a better way to have a cross country comparison. The emission intensity is calculated by dividing the CO2 emissions of a country in a certain year in grams by the cars on the road in that same year and this outcome is further divided by the average number of kilometres of a car in that year in that country. The graph below on the left shows the emission intensity of major EU27 countries. The emission intensity for EU27declined slightly in recent years, but is still higher than in 2011. For Germany, the emission intensity has decreased while it increased in Italy. The emission intensity in the Netherlands and Spain has been declining.

What is needed for emission intensity to decline? A larger share of new cars that emit lower emissions (because of regulations) on the road will result in lower emissions. A larger share of zero emission or hybrid cars will result in even lower emissions if the total fleet doesn’t change.

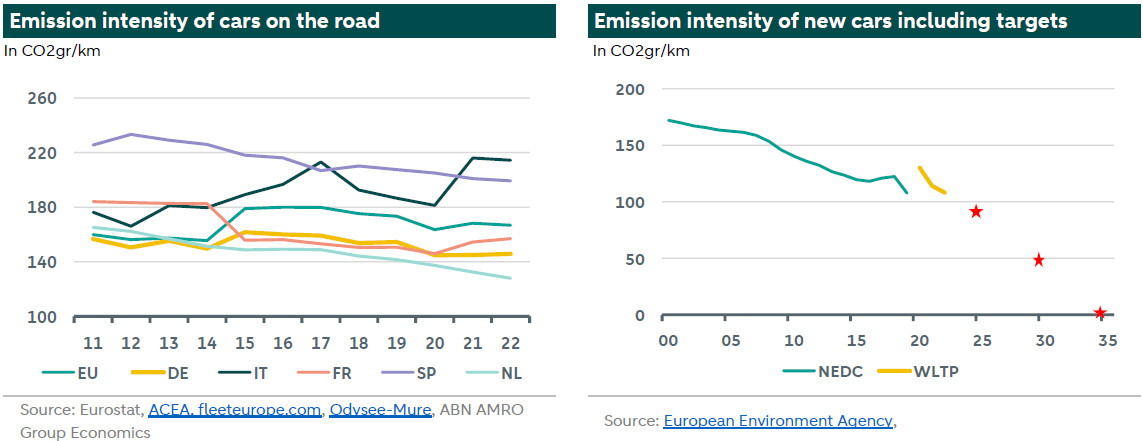

The graph above on the right shows the emission intensity of new cars under different emission test procedures. The green line is based on New European Driving Cycle (NEDC) emission test procedure and the short yellow line is the Worldwide Harmonized Light Vehicle Test Procedure (WLTP). The red stars are the EU-wide fleet targets for new cars. We go into more details in the EU policy section below.

Compared to 2021, 2022 saw the average CO2 emissions of new registered passenger cars fall by 5.3% to 108.1g CO2/km. The main reason for the reduction is the growing share of electric vehicle (EV) registrations, which increased from 19% in 2021 to 23% in 2022, divided between 13.5% full electric and 9.5% plug-in hybrid electric vehicles. The Netherlands has the lowest emission intensity because of the highest share of battery electric vehicles, plug-in hybrid and hybrid electric cars in its fleet and as share of new cars.

Current policy targets for the EU

The EU has set as target to reduce greenhouse gas emissions by 55% by 2030. As indicated above, cars account of 16% of the total EU emissions. The EU is very specific in its 2030 climate target impact assessment on how it aims to reach the targets (see more ). According to the impact assessment, the historical annual average emission reductions were 1.3% up to 2020. Between 2020 and 2030 the annual reduction percentage should be 2.7%.

The EU has set out a set of specific policies for cars. First, by the end of 2025 there needs to be charging stations every 60km on main roads for car/trucks under 3.5 tonnes. Second, in 2027 ETS-II will come into force for buildings and road transport sector. This will make driving with internal combustion engine cars burning fossil fuels more expensive.

Third, by 2030 the EU has a 55% reduction target for new cars compared to 2021 levels (the red star at 2030 in the graph on the right above). Regulation (EU) 2019/631 set a fleet-wide target of 95g CO2/km for the years 2020-2024 for new passenger cars, based on the New European Driving Cycle (NEDC) emission test procedure. This is equivalent to 115.1g CO2/km when using the Worldwide Harmonised Light Vehicle Test Procedure (WLTP). Since 2021, the specific emission targets for manufacturers, either individually or organised in pools, are expressed on the basis of the WLTP, which results in higher emission values than the NEDC. To help achieve the EU’s climate targets, from 2025 onwards, stricter EU-wide fleet targets (WLTP) will apply: 93.6g/km until 2029 (15% reduction compared to the 2021 baseline), 49.5g/km from 2030 to 2034 (55% reduction) and 0g/km from 2035 (100% reduction) (see more ). The three targets are the red stars in the graph on the right above. With these policies the EU aims to achieve its emissions reduction targets.

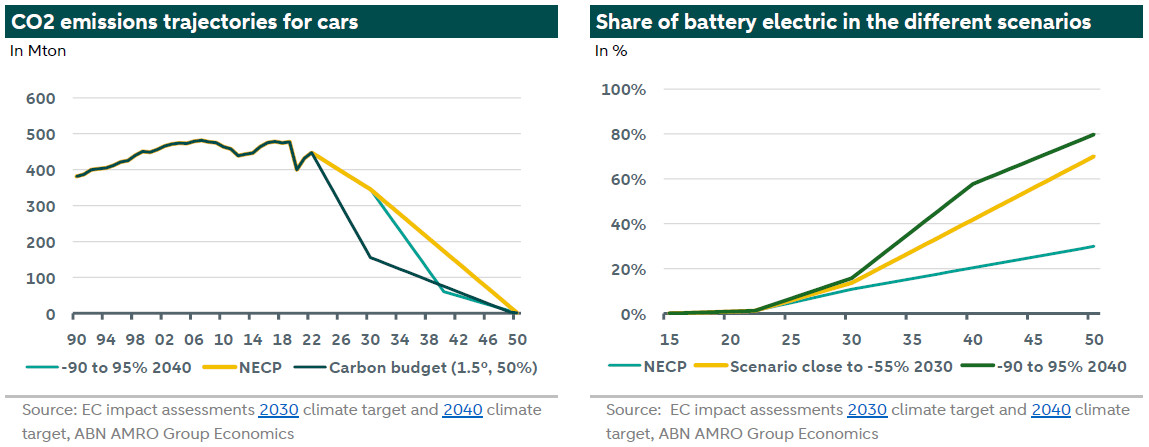

The graph below on the left below shows the CO2 trajectories for the NECP scenario and the scenario close to -55%. The NECP is the scenario according to the National Energy and Climate Plan of the countries.

The impact assessment has detailed information about the CO2 emissions from transport including per sub-category. Indeed, the CO2 emissions from cars are expected to decline from 447 Mton in 2022 to 328 Mton for the close to 55% reduction and 345 Mton for the NECP scenario (see graph above). This is a decline between 23-27% (for the entire fleet). As also indicated above currently a large percentage of cars consumes fossil fuels. In 2030 cars burning fossil fuels are still expected to be dominant, but the role of battery electric is increasing to 11-14% of the total fleet.

Many of the biggest legacy automakers set ambitious EV targets earlier this decade. This was complemented by setting ICE phase-outs for 2030s or high levels of EV sales. Since 2023 many of these automakers have changed their communication. They have softened or even cancelled some of their goals according to Bloomberg NEF. In the first half of 2024, the share of global passenger vehicles sold by automakers with ICE phase out announcement and EV-only automakers was only 29%. So, 71% has not committed. This was up from 66% in 2023. This trend together with the EU China car tariffs make it less likely that the share of EV will rise substantially. Yet the share of zero emission vehicles would need to increase to lower the CO2 emissions and to improve the emission intensity.

European Commission proposal for climate targets beyond 2030

In February 2024, the European Commission set out a proposal for climate targets beyond 2030. It formulated three different scenarios. Target option 1 is a net GHG reduction target of up to 80% (S1). This is compatible with a linear trajectory of net GHG emissions between the existing 2030 target and the 2050 climate neutrality. Target option 2 is net GHG target reductions in 2040 of at least 85% and up to 90% (S2). Target option 3 is a net GHG reduction target in 2040 of at least 90% and up to 95% (S3). The Commission recommended a target somewhere in between S2 and S3. Next to these scenarios, there is a LIFE or more sustainable lifestyles scenario (European commission 2040 proposal impact assessment part 3, see more ). In this report, we mainly focus on proposal S3 (90-95%).

The total amount of energy consumed by the EU’s transport sector is projected to decline significantly because of large-scale electrification (notably in road transport) and implementation of technological and operational measures to improve energy efficiency (notably in maritime and air transport). Furthermore, the fuel mix of the transport sector is projected to undergo a deep transformation characterised by a significant reduction in the consumption of fossil fuels, which are largely replaced by zero- and low-emission energy (such as hydrogen) and almost fully replaced by them by 2050.

The direct CO2 emissions are expected to decline from 447 Mton in 2022 to 345 Mton in 2030 (NECP) to 60 Mton under the 90-95% scenario of 2040 to below 1 Mton in 2050. This is a decline of 23% between 2022-2030 and a decline of around 83% between 2030 and 2040.

The graph above on the left shows the CO2 pathways of NECP scenario of the current policy, the 90-95% proposal of the EC and the pathway of the carbon budget of 2023-2050 for 1.5% with 50% probability. As there is no agreed distribution of the global carbon budget yet we have assumed the budget is based on current share of emissions (see more on the carbon budget here, and ). What clearly stands out is that neither the current policy nor the 90-95% proposal are consistent with a trajectory with the carbon budget consistent with 1.5° (with 50% probability). The graph on the right shows the share of electrification of the fleet under the NECP scenario, the MIX scenario and the proposal of 90-95%. The adoption of zero emission cars (battery electric or fuel cell) is crucial in bringing down emissions. The quicker the large scale adoption, the quicker emissions will decline. So a steeper decline in CO2 emissions goes hand in hand with a substantial increase of zero emissions cars on the road.

Climate policy in main EU27 countries

The EU targets for mobility such as the ban on the sale of new fossil fuel cars in 2035 apply to the individual member states. Some countries have opted for more ambitious targets for example the Netherlands. The Netherlands has a ban on the sale of new fossil fuel cars in 2030, 5 years before the EU (more on this in the next section).

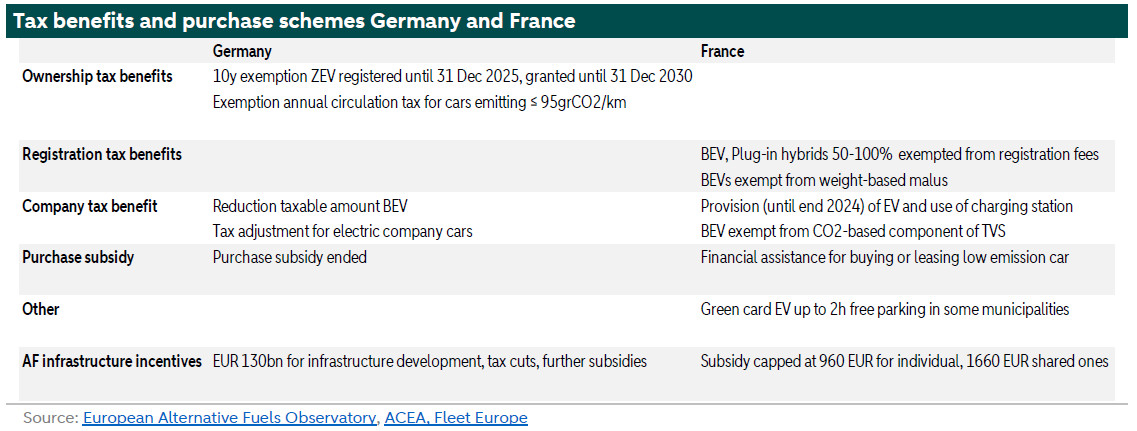

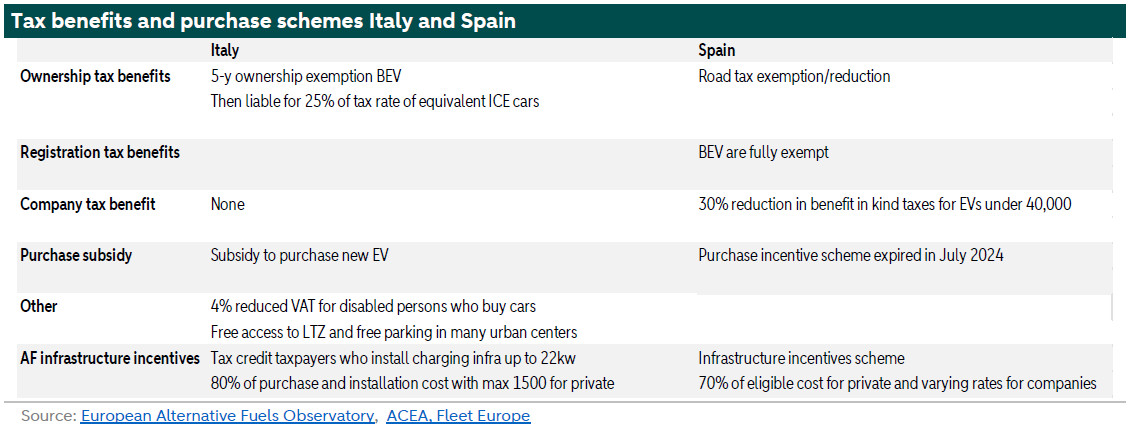

Every member state delivered a National Energy and Climate Plan (NECP discussed above) showing how to plan to reach the target. They also provide details on how they aim to decarbonize the different sectors. The tables below show the tax benefits and purchase schemes for electric cars. We have chosen the largest countries and the countries with large changes in emissions. For the Netherlands, we will go in more details in the next paragraph.

At the end of 2023, the German government prematurely ended its electric car subsidy programme. The economy and climate ministry () in a press release on 16 December that applications for the subsidy of up to 4,500 euros for the purchase of a battery-electric car are no longer possible. It also said that a total of 2.1 million electric vehicles had been subsidised under the scheme, with payouts adding up to around 10 billion euros since its inception in 2016. And that it was a success. Germany still has other policies in place to support electromobility.

In Spain the purchase subsidy expired in July 2024. Also in the Netherlands, the tax benefits and purchase scheme for electric cars will become less favourable. This comes at a time that electric vehicles are still at a very small percentage of the cars on the road and zero emission vehicles are crucial in reducing emissions and sales are declining. In August, just 92,627 battery-electric vehicles (BEVs) were sold across the EU, a sharp contrast to the 165,204 units sold during the same period in 2023. This marks the fourth consecutive month of declining EV sales, shrinking their market share from 21% to 14.4%. The decline is most pronounced in Germany, where sales plummeted by 68.8%, and France, which recorded a 33.1% drop. However, in France and Italy the financial assistance/subsidy in buying low emission cars is still in place.

Changes in policy under the new Dutch government

Some of the Netherlands’ climate goals will remain broadly intact according to the plans of the new coalition. For instance, the 2030 target for the reduction of GHG emissions has remained at 55% (compared to 1990 levels), although this is no longer a minimum reduction, and the extra buffer will be skipped (see more here). That said, some changes to the existing policy plans are on the cards, which seem to imply that the Netherlands will not meet the 55% reduction target.

The Netherlands remains committed to strengthening current European vehicle standards, including intermediate targets by 2030. In doing so, the Netherlands still advocates phasing out new fossil vehicles in 2030, five years earlier than the EU (2035). The car fleet in the coming years will consist of both electric and fuel cars. The government wants to ensure that the burden is shared fairly between these groups in order to keep driving affordable. At the same time, sufficient support must remain for electric cars so that the Netherlands can achieve its climate goals and nitrogen emission reductions. Because income from car taxes is declining due to the increase in electric vehicles, the government will look for a stable tax system. This plan will be presented in the first quarter of 2025 and will take into account the CO2 reduction targets from the Netherlands' Recovery and Resilience Plan.

The new government has already reduced support for electric vehicles and announced three changes on Budget Day (Prinsjesdag). First, the new government decided to make changes to the policy to stimulate electric cars. Currently, electric cars are still exempt from motor vehicle tax (MRB), and a quarter rate applies for 2025. But the government decided to give a smaller rebate on motor vehicle tax for electric cars in 2026 than previously assumed. To compensate for the higher weight of electric cars compared to fuel cars, a 40% discount on the MRB was set earlier this year but this will be changed into a 25% discount in 2026. In 2030 there will be no more discount. According to the ANWB this will make the same electric car in 2026 almost 8,000 euros more expensive than it was in 2022.

Second, next to the motor vehicle tax there is a direct tax called tax on passenger cars and motorcycles (BPM). BPM is almost entirely linked to the CO2 emissions from cars. BPM amount now consists of a fixed base of 440 euros plus an amount determined by CO2 emissions. The more CO2 a car emits, the more BPM is levied and thus the more expensive it becomes to drive internal combustion vehicle. But battery electric cars have no tail-pipe emissions, so their owners currently don’t pay BPM. The BPM exemption for electric cars is going to disappear as early as 2025. There will be a standard rate or fixed rate of 660 euros, also for EVs. Third, the purchase subsidy for electric cars will end. Starting 2025 there will be no longer subsidy for a new EV (now EUR 2,950) or second-hand EV (2,000).

Conclusion

EU27 CO2 emissions are on a declining trend versus 1990 except for mobility. But CO2 emissions in transport including cars are well above the 1990 levels. The EU has set very ambitious targets to bring down emissions including for cars. However, the only way to reduce emissions from cars is to increase the share of zero emission cars in the fleet. After a substantial increase in demand for EV from very low levels, EV sales are declining. Zero emission cars are still only a few percentage points of the total fleet while at the same time incentives to buy these cars are being reduced. Moreover, to keep some hope of limiting global warming to 1.5°, emissions need to be reduced substantially in the coming years otherwise emissions exceed this carbon budget. So there is need for more incentives rather than less.