US - Still humming along

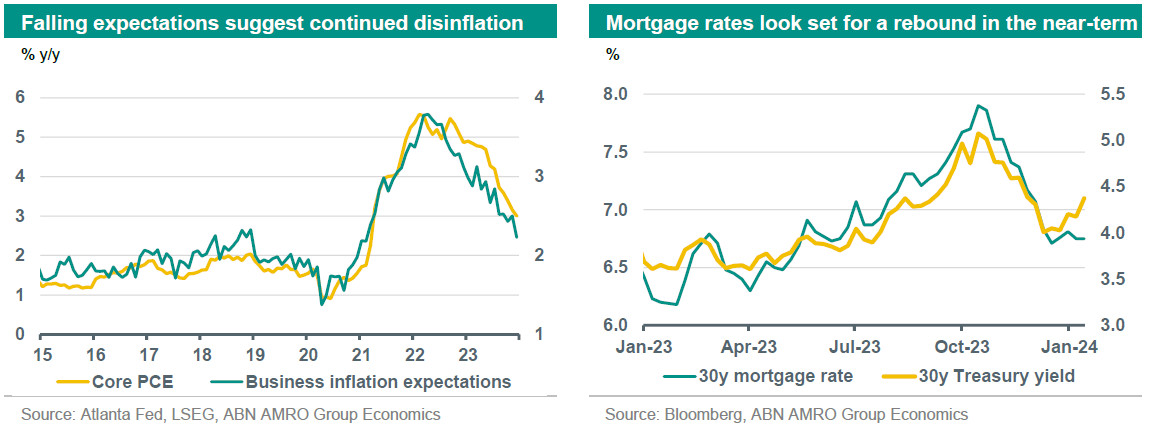

The economy is clearly slowing, but it also continues to outperform expectations. Meanwhile, falling business and consumer expectations suggest the disinflation trend is set to continue. The drop in mortgage rates last year is already giving some stimulus to housing, but a bump in the road has materialised, with markets beginning to pare back rate cut expectations. The Fed is still not aggressively pushing back on market rate cut expectations. We continue to expect rate cuts to start in June, leaving room for a further near-term recovery in bond yields.

Incoming data suggests the US economy clearly slowed as 2023 drew to a close, following the blockbuster Q3 growth reading. However, the economy also continues to defy expectations for a sharper slowdown. Q4 GDP came in at 3.3% q/q annualised, which was well above our expectation back in December for nearer 1% growth. The main driver was an unexpected rise in inventory build, and GDP looks vulnerable to an unwind of this in the coming quarters. However, the ever-almighty US consumer was also resilient: following above trend growth of 3.1% annualised in Q3, consumption barely paused for breath in Q4, growing at 2.8% annualised. This strength comes despite the headwinds from slowing jobs and wage growth, and continued high interest rates. Indeed, while headline payrolls growth has surprised to the upside in recent months, downward revisions to prior months have meant a clear overall slowing trend: 3 month average jobs growth fell from 221k in September to 165k in December. For the time being, consumers continue to dip into their excess savings to keep consumption humming along, but as jobs growth slows further, we expect consumers to become increasingly cautious.

One area that may partly offset the expected slowdown in consumption is housing. Leading indicators suggest homebuyers are being brought in from the sidelines by the sharp decline in mortgage rates, which fell over 1pp from nearly 8% in October to below 7% in late December. For instance, Redfin pending home sales jumped 4.1% m/m in December – the biggest rise in over two years – while the NAHB homebuilder sentiment index rose 7 points to 44 in January. Increased housing demand is likely to drive a recovery in housing investment, although it should be noted that housing is a much smaller part of the economy than it was before the 2008-9 Great Recession, and so this will likely only provide a modest uplift to growth.

Even this boost from lower rates may be about to hit a bump in the road. The disinflation trend of the past 18 months shows no signs of letting up: the Atlanta Fed’s year-ahead business inflation expectations dropped another leg lower in January to 2.2%, while the equivalent consumer measure from Michigan University fell to 2.9%. These were the lowest readings in three years. However, the aforementioned resilience in the economy is likely to keep the Fed on its guard in the near-term, and our base case continues to foresee rate cuts starting in June. Markets have to some extent priced out the probability of earlier rate cuts, but there is still some way to go: the first fully priced 25bp cut is in May, and markets still see a 50% probability of a cut in March. So far, Fed officials are not pushing back against market expectations quite as forcefully as ECB officials. But as it becomes increasingly clear that the Fed is not on the verge of cutting rates, bond yields – and therefore rates that impact the real economy, such as mortgage rates – could yet see some further upward pressure in the near-term, before rates resume their fall later in the year.