SustainaWeekly - Acute physical risks have larger impact in the new NGFS scenarios

In November, the fourth vintage Network for Greening Financial Services (NGFS) climate scenarios were published. In this week’s SustainaWeekly, we compare these scenarios to the previous set. Orderly scenarios now include disorderly elements. New scenarios communicate the risks of lack of coordination, and role of behaviour adaptation. Acute physical risk estimates are larger and more granular. In our next note, we turn to the revised and recast Energy Performance of Buildings Directive (EPBD) to evaluate the potential impact it can have in the European building sector and more specifically, for green bond issuers. Our final note continues where our carbon capture note in the SustainaWeekly of 20 November left off: how to transport the captured CO2.

Economist: The fourth vintage Network for Greening Financial Services (NGFS) climate scenarios were just published. Compared to the previous set, orderly scenarios now include disorderly elements. New scenarios communicate the risks of lack of coordination, and role of behaviour adaptation. Acute physical risk estimates are larger and more granular.

Policy: The revised and recast Energy Performance of Buildings Directive (EPBD) aims to accelerate energy efficiency improvements - one of the sub-initiatives under the EPBD is the Energy label/EPC harmonisation. The harmonisation will hardly change the labelling for German, French and Belgian properties, despite a generally weaker quality of properties in the former two countries. Yet, Dutch properties with strong labels currently could face downgrades under the harmonisation proposal.

Sectors: In our SustainaWeekly of 20 November, we did a deep dive into technologies and techniques of carbon capture. We now focus on the transport of the captured CO2. To transport CO2, the state is important. CO2 is mainly transported via pipeline, as this is a mature technology and other transport methods are not yet mature enough. Risk of corrosion and effect of impurities in CO2 on the infrastructure are the main challenges for transporting CO2. Transport costs may vary significantly.

ESG in figures: In a regular section of our weekly, we present a chart book on some of the key indicators for ESG financing and the energy transition.

Acute physical risk impact is larger and more granular in new NGFS scenarios

In November, the fourth vintage Network for Greening Financial Services (NGFS) climate scenarios were published

Compared to the previous set, orderly scenarios now include disorderly elements

New scenarios communicate the risks of lack of coordination, and role of behaviour adaptation

Acute physical risk estimates are larger and more granular

Introduction

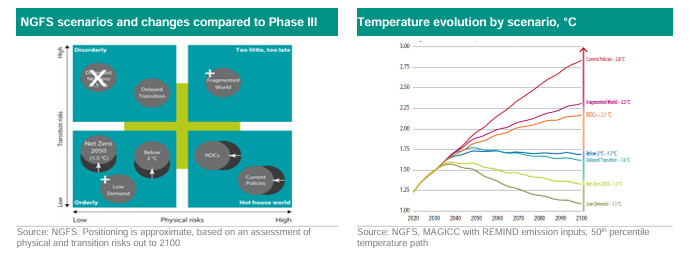

On 7 November, the Network for Greening Financial Services (NGFS) published the fourth of its climate scenarios. This is an update from the third vintage, which was published in September 2022. The scenarios are updated to reflect realised developments & commitments. The scenarios have been revised and there are two new scenarios, while one scenario has been discontinued. Also, there is additional coverage of acute physical risk, to include more hazards and additional geographical and sectoral granularity. In this round, the use of Carbon Dioxide Removal (CDR) methods has been limited due to lower availability of these technologies

The scenarios show slow progress being made in lowering temperature outcomes

Compared to last year’s scenarios, lower 2100 temperature outcomes are associated with each scenario (with the exception of the delayed transition scenario, which remains unchanged). Current Policies for the world as a whole now leads to 2.8°C compared to 3.2°C in the third vintage scenarios. Nationally Determined Contributions (NDCs) now lead to 2.1°C, against 2.6°C last year. This makes sense as over the past year some progress has been made, particularly in implementing the NDCs in current policies. An important example is the EU’s Fitfor55 plans, and the US’s Inflation Reduction Act. However, the shifts also show the slow pace that change is taking, while another year has gone by.

Net Zero scenario now has some disorderly elements

The Net Zero 2050 scenario was a 100% orderly transition scenario in last year’s set of climate scenarios. In the fourth vintage the orderly scenarios have more disorderly elements, reflecting climate policy delays and the energy crisis following the war in Ukraine. The (shadow) carbon price is higher compared to the previous Net Zero scenario, reflecting the need to reach the same climate goal in a shortening time frame. Energy demand is higher compared to the previous one, reflecting a higher starting point. Energy investments lag behind what is required in the period until 2030 and are thus much higher starting in 2030, to meet the 2050 goal.

New scenarios communicate the risks of lack of coordination, and role of behaviour adaptation

Previous vintages of the NGFS scenarios included a scenario in which Net Zero was reached, but in a disorderly and uncoordinated fashion. This Divergent Net Zero scenario is cancelled in the new vintage “given the reduced likelihood of a successful uncoordinated transition”. In its stead, there is a new scenario in the previously empty “too little, too late” quadrant, where both physical and transition risks are high. The Fragmented World scenario assumes delayed and divergent climate policy ambition globally, leading to elevated transition risks in some countries and high physical risks everywhere due to the overall ineffectiveness of the transition. This is a relevant scenario for the EU. As a frontrunner in the transition, the EU would be one of the regions in which high transition and high physical risk would combine. The scenario also assumes divergence of abatement ambition per sector, as evidenced in different carbon prices for transport and buildings compared to industry and supply. The combination of these divergent efforts across countries and sectors leads to even higher transition risks than in the Delayed Transition scenario, in which transition risks are subdued by efficient inter-regional and inter-sectoral distribution of transition efforts. The other new scenario, Low Demand, scenario is an orderly scenario which combines a lower temperature pathway and a less progressive (shadow) carbon price. Significant behavioural changes in energy generation and consumption activities are the key distinguishing feature of this scenario and it is meant to emphasize the role that behavioural changes play.

Acute physical risk impacts are larger and more granular

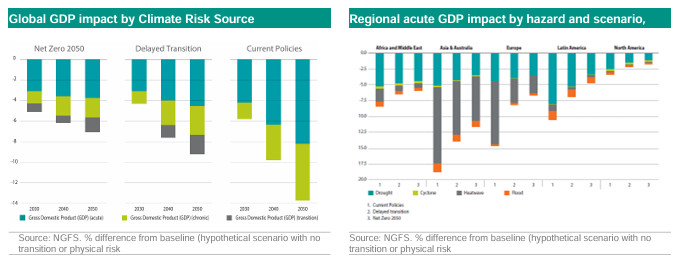

Acute physical risk modelling has been enriched to include more hazards and increasing geographical granularity. In the previous version, there was some coverage on a global scale of acute physical risk. The fourth vintage expands the coverage of acute physical climate risks and specific hazards, such as heatwaves, droughts, floods, wildfire, and storms, and their impact on the macro economy. This is in addition to the chronic physical risk, which is the effects of the trend temperature change on for instance labour and agricultural productivity. The following chart shows the GDP deltas for 3 scenarios in comparison to a baseline scenario. This baseline scenario represents a world without climate change. From the chart it is clear that climate change has a negative impact on GDP in every plausible scenario, but the magnitude of the losses differs among them. As in the previous vintage, physical risk is the most pertinent of the types of climate risk. And it has grown in importance: acute physical risk associated with the four modelled hazards (cyclone, drought, heatwave, flood) is estimated to result in GDP losses of 8% by 2050 in the Current Policies scenario. For comparison, in phase 3 the overall acute risk GDP losses were estimated to be about 1.4% relative to the baseline for the Current Policies scenario by 2050.

While the new numbers bring the total physical risk impact (chronic and acute together) to an almost 14% global GDP loss to the global economy by 2050 in the Current Policies scenario, it is good to realise that these estimates are still likely to be an underestimation. Second round effects (for instance mass migration), potential tipping points (such as in permafrost thaw) and the fact that the climate change currently appears to be happening more quickly than anticipated have not been taken into account. Of the four hazards, drought and heatwaves represent the largest sources of risk across regions. Increased geographical granularity shows that Europe and Asia are mostly exposed to heatwaves, while Africa and North America is primarily exposed to drought.