Ripple effects - Exploring the impact of low Rhine water levels on the Dutch economy

The Rhine, the busiest river in Europe, is of great economic importance. Due to drought, both in 2018 and 2022, there have been episodes where the water level in the Rhine has dropped to critical levels, severely limiting inland shipping. According to the Kiel Institute for the World Economy, in November 2018, low water levels led to a drop in industrial production by 1.5 percent, causing a decline of German GDP by 0.4 percent. 1)

Co-author: Dirk Jansen

Episodes of low river water levels can be thought of as climate-induced adverse supply shocks that should result in lower output and higher prices. In this paper, we focus on the volume effects of low water level in the Rhine. More specifically, we examine the impact on freight volumes transported along river in the Netherlands and on Dutch industrial and construction output since 2005. Our analysis shows that international freight volumes fall when the water level drops below a critical level. The impact on domestic freight is not statistically significant. We also find that the short run effect of low water levels on Dutch industrial output is insignificant. However, as the climate warms up further, droughts might have a significant impact in the future.

Introduction

The Rhine, which starts in the Swiss Alps, runs along the German-French border, flows through inland Germany and finally reaches the North Sea through the Netherlands, is Europe’s busiest river. Some 7,000 inland ships travel the Rhine, shipping 200 million tonnes across the Dutch-German border on a yearly basis. Every day, some 600 ships traveling the Rhine pass the Dutch-German border, the majority of which sail under a Dutch flag. The Rhine is the most important transportation route for German industry, connecting the Port of Rotterdam, Europe’s largest port, to Rhine-Ruhr region, Germany’s industrial heartland.

In recent years, most notably 2018 and 2022, there have been drought episodes that led to critically low water levels in the Rhine, which severely limited inland shipping, choking German industry. Lower water levels gradually restrict the transport capacity of inland ships, as the maximum available draught of the ship is reduced. At certain water levels, ships cannot pass each other at narrow bottlenecks, further reducing the transport capacity of the river. Finally, if the water levels falls below the minimum allowable depth for inland transport, traffic grinds to a halt. The major bottleneck in the Rhine is located at the German town of Kaub. According to the Kiel Institute for the World Economy, if water levels at Kaub fall below 78 centimetres for 30 days, industrial production falls by 1 percent. Industries that are located at the Rhine include the steel industry, the chemical industry and producers of building materials.

The Rhine has a pluvio-nival regime, meaning that it is a snowmelt and rainfed river. As the weather gets warmer in spring, snow in the Alps starts to melt, gradually releasing water into the Rhine. Water is temporarily stored in the Alpine border lakes, which has a smoothening effect on the Rhine discharge. Downstream of Basel, the pluvial regime of the Rhine gradually increases in domination.

However, due to climate change, the Rhine regime will change. As the climate becomes warmer, the amount of precipitation increases. There will also be more precipitation in winter, but because of higher temperatures, there will be less snow. Since the snow cover will decrease, the snow will melt faster in spring. Moreover, a warmer climate leads to an increase of the frequency of extreme, high-intensity rainfall events. Thus, the Rhine will turn into a rainfed river, and water levels in the river will become more volatile. This leads to an increased risk of extremely high water levels and floods, mostly in spring. In the summer, there will be less precipitation. On top of that, due to higher temperatures, more water will evaporate. This combination leads to an increased risk of extremely low water levels.

This is why it is important to understand the economic effects of water levels. This paper examines the effects of low water levels in the Rhine on Dutch manufacturing and construction.

Data

Data on the water level in the Rhine was sourced from Bloomberg and the Dutch Department of Waterways and Public Works (Rijkswaterstaat). Data on inland shipping -? cargo volumes and economic output of industrial sectors and construction was sourced from Statistics Netherlands (CBS).We test multiple versions of the relationship where we split the cargo into wet, bulk and container and where possible, the total volume of freight, the total distance travelled, and the volume multiplied by distance. The CBS also split the freight data into domestic, outbound, inbound and throughput. We explore each of these relationships separately. The world trade data is from CPB.

Methodology

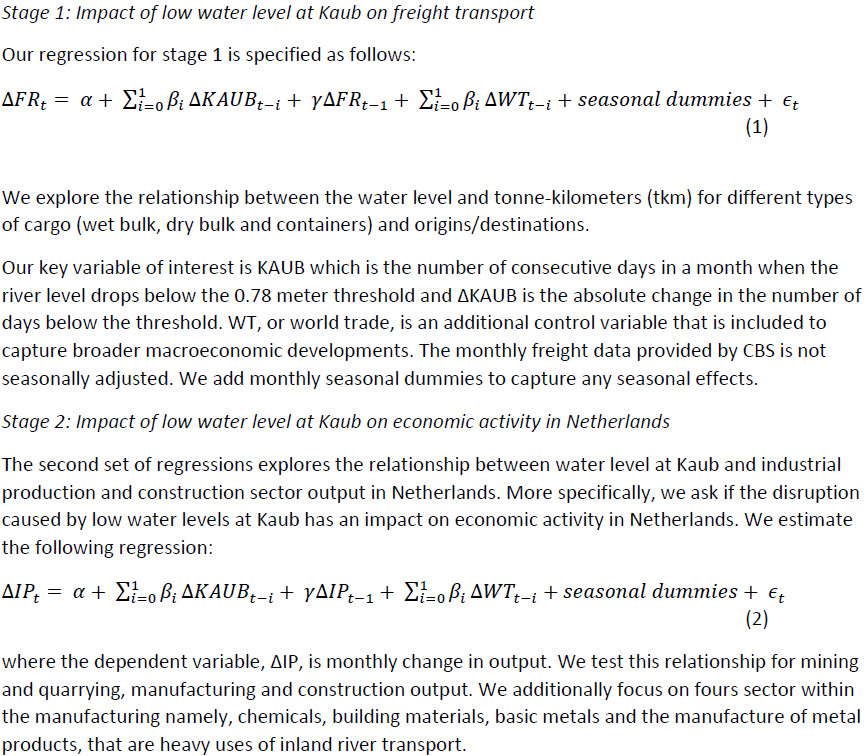

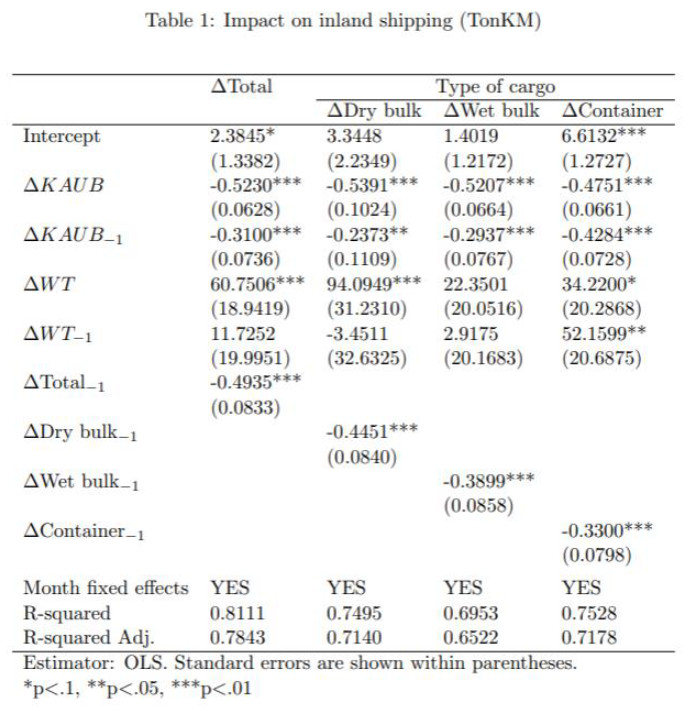

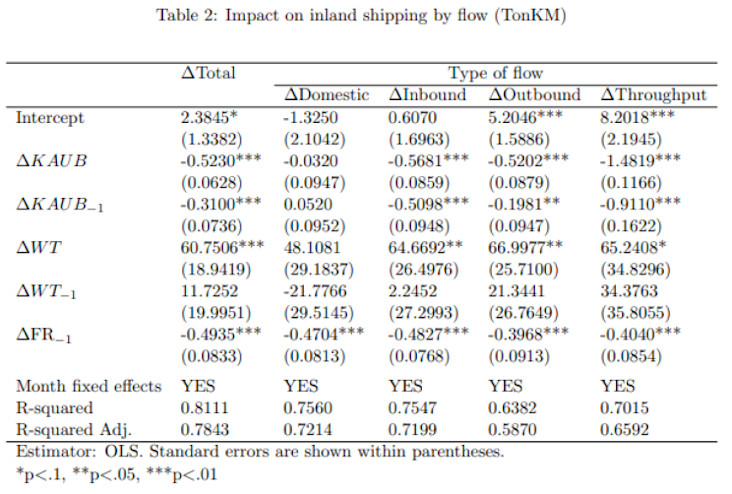

Our empirical analysis is split into two stages. In stage one, we explore the impact that the low water level, as measured at Kaub, has on freight that is transported along the Rhine in the Netherlands. In the second stage, we estimate the impact of low water levels on industrial production and construction in the Netherlands.

Results: Impact on freight transport

The results from the regression analysis in Stage 1 are summarised in Table 1. The analysis shows that low river levels at Kaub have a significant impact on freight transport[BB1] in Netherlands. An additional day of low water level reduces the total weight that is transported along the river by 0.5%. This implies that a string of thirty consecutive days below the threshold will reduce freight transport by around 15%. Our analysis also shows that the effects linger on - the coefficient on the first lag of the water level is -0.3, implying that thirty consecutive days below the threshold leads to a cumulative 24% reduction of freight transport over two months. Both coefficients are significant at the 1% level and the results are robust across the different categories of cargo (wet, bulk and container).

To place this in context, the most severe recent period of drought occurred in the second half of 2018 when the water level fell below the threshold for around 80 days. More recently, in 2022, the water level dropped for 37 consecutive days.

Next, our analysis shows that inbound, outbound and throughput freight is severely impacted by low water levels and this is most pronounced for container freight, but also relevant for dry and bulk cargo. A noteworthy exception is domestic freight which is largely unaffected by the low water levels in Kaub.

The significance of the water level at Kaub for river freight in Netherlands is largely driven by international freight (inbound, outbound and throughput) and as such it reflects the importance of global trade for inland river transport in Netherlands with Rotterdam as a major European port and Germany a major manufacturing exporter and importer. Our results also show that the low water levels at Kaub does not result in a significant amount of disruption in freight that exclusively travels on inland waterways within Netherlands.

One important reason for the divergence between domestic and international freight is that the water in and around Netherlands tends to be deeper compared with Kaub. For example, the Rhine is, on average, around 1.8 meters higher in Duisberg-Ruhrort compared with Kaub and the lowest reading at Duisberg-Ruhrort in the last five years was 1.5 meters which is well above the critical threshold.

Results: Impact on Dutch industry and construction

The results of stage 2 of our analysis for the main sectors and the sub-sectors are presented in Table 2 and 3 below:

The message is consistent across all the sectors that we have considered – episodes of low water levels at Kaub do not have a significant impact on economic output. In other words, the industrial output in Netherlands is largely unaffected by developments on the Rhine at Kaub. This is the case for the major industrial groups as well as the four manufacturing sub-sectors.

The second stage results are also consistent with our finding that the volume of domestic freight transport within Netherlands is immune to developments on the Rhine in Kaub.

Limitations

This paper only examines the impact of low water levels on the Rhine on Dutch industrial and construction output but there is also an increased possibility of of extremely high water levels and floods. High water levels could impact shipping as well, because it can impact the operation of inland terminals or make inland waters unsafe due to floating objects, or because ships cannot pass under bridges or through waterway locks. We do not consider the impact of high water levels in this analysis.

Also, the relationship between low water levels in the Rhine and the output of Dutch industry could be non-linear. As the climate warms up further, drought episodes might become even more severe in the future, which could lead to even lower water levels. While the water in the Dutch part of the Rhine is deeper than in Germany, even lower water levels could also impact inland shipping within the Netherlands. Research from the Kiel Institute for the World Economy into the impact on the German economy shows that the economic impact can be significant.

Another limitation is that an increasing frequency of droughts could damage investment in Germany. As Germany is The Netherlands’ most important trade partner, this could lead to second and third order effects.

Finally, our analysis is restricted to the volume effects of low water levels but there is also a freight cost element that comes into play when the river water levels fall below different thresholds. Vessel owners impose a 'low water surcharge’ which is inversely proportionate to the water level – the surcharge rises as water levels falls. Those costs represent the immediate and direct costs of low water levels on the Rhine, but in addition, there are other indirect costs as well that we do not consider in our analysis. For example, the disruption to the water level might encourage firms to prepare for imminent disruptions by building and maintaining new warehouse facilities and holding higher levels of inventory.

Conclusion

In this note, we assess the impact of low water levels on the Rhine on Dutch inland water freight transport volumes and Dutch industrial production. We show that disruptions to the river level caused by drought have a significant impact on the volume of freight that is transported along the river in the Netherlands. The impact is most pronounced on international freight rather than on domestic freight. More specifically, we find that thirty consecutive days below the threshold leads to a cumulative 24% reduction of freight transport over two months.

The drought episodes that have caused damage to the German economy in 2018 and 2022 and to Dutch inland water freight volumes did not have a significant impact on Dutch industry and construction sector output. One important reason for the dichotomous results is that many Dutch industrial firms are located at the shore or at sea ports, which leaves them largely unaffected by lower water levels in the Rhine. Another explanation is that most of the German economic activity that is hurt by low water levels is located upstream of the major bottleneck Kaub. As the Netherlands is a lower country and is located downstream of Kaub, water is significantly deeper in the Dutch part of the Rhine. Our analysis finds that inland shipping within the Netherlands was not affected by the drought episodes in 2018 and 2022.

While Dutch economic output is less affected by low water levels in the Rhine than the German economy, caution is advised. The Rhine is currently a snowmelt and rainfed river. As the climate becomes warmer, the water levels will depend more on rain, and the frequency of extreme rainfall events will increase. Thus, the Rhine will turn into a rainfed river, and water levels in the river will become more volatile, which leads to an increased risk of floods in spring and an increased risk of extremely low water levels during the summer. Our study focussed on the short run volume effects of low river levels, but there are also the adverse price effect from the 'low water surcharge’ and the longer term effects of adaptation, which might trigger a switch to more expensive road transportation, additional warehousing facilities and higher levels of inventory. The longer term price and volume effects require further investigation.

Finally, more frequent drought episodes and floods, which hamper industrial output and lead to higher transportation costs for businesses, could hurt business investment in German industry, a capital-intensive sector. Since this problem is expected to become more serious in the future due to climate change, and Germany is The Netherlands’ most important trade partner, the Netherlands should also be worried about Rhine water levels.

1) Ademmer, M., Jannsen, N., & Meuchelböck, S. (2023). Extreme Weather Events and Economic Activity: The Case of Low Water Levels on the Rhine River. German Economic Review, 24(2), 121-144.

Erratum June 2024: the first version of this report mixed up water level and water depth. This has been corrected in this version.