Oil market update - Oil prices settle on signs of de-escalation

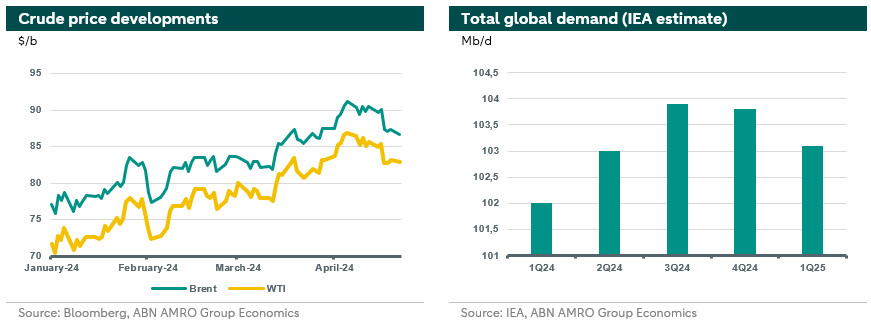

Crude prices have remained on an upward trend and witnessed a price surge beyond the 90$/b level driven by a supply deficit and more importantly the escalation of geopolitical risks. Meanwhile, the IEA revisited its oil demand growth forecasts downwards for 2024 and 2025 citing a higher speed of EVs adoption in advanced economies as a main driver. The market’s bullish sentiment was fuelled by fears that conflict between Israel and Iran would escalate in to a full-blown war, which could damage Iran’s oil supply capacity . Subsequent signs of de-escalation have seen the risk premium in oil prices diminish and confirmation of this could see Brent oil prices trending around 85 $/b.

Brent prices have averaged 87.8 $/b since mid-March. The upward trend since the start of 2024 is continuing, driven mainly by the tight supply with OPEC+ voluntary cuts still in place and the geopolitical escalations in the conflicts in Ukraine and the Middle East, with the Ukraine hitting Russian refineries and the unprecedented Iranian attack on Israel. Furthermore, among traders, perceived demand strength is one of the factors that contributed to the current surge in prices. Accordingly, we recently saw a surge in the Brent price to well above the 90 $/b level.

In its latest report, the IEA is expecting slower growth in global oil demand for 2024 and 2025 (1.2 mb/d and 1.1 mb/d, respectively) than what was previously communicated. The main driver for this change is a further reduction in consumption and the speed of the proliferation of EVs in advanced economies which dominate the expected demand increase from China and India. This view comes in contrast to that of OPEC, which expects the growth in oil demand to be much higher than the IEA’s estimates by around one million barrels a day.

From the supply side, early April, an OPEC+ commissioned panel recommended no change to the group’s ongoing output cuts. That is OPEC+ maintained their cuts for the second quarter of 2024, keeping the market tight with almost 2 mb/d off the market. Furthermore, shipments from Mexico went down by around 35% in March as the Mexican president tries to deliver on his promises to reduce the costs of fuel imports. The Mexican move adds to the impacts of lower than average US stockpiles late March, the unrest in Libya, the sabotage of a pipeline in South Sudan, and the US sanctions affecting the transport of Russian oil to Asia. All these effects are participating in the creation of a supply deficit in the crude markets.

The IEA expects OPEC+ to keep their cuts until the end of 2024 and for Non-OPEC+ countries to increase supply, especially from the US, Canada, Brazil and Guyana, adding around 1.2 mb/d in 2024 and 1 mb/d in 2025. While other organizations such as the US Energy Information Administration (EIA) expects the cuts to end in the second half of 2024. The decision on the possibility of an extension of cuts is due during OPEC’s ministerial meeting in June. If cuts were to be extended, inventories are expected to keep declining with the largest decrease to be in the third quarter of 2024, according to the IEA. This would also be the summer driving season in the US and Europe, which would put further upward pressure on prices.

Geopolitical tensions have been taking their toll on oil prices. Starting from the attacks on Russian refineries by Ukrainian forces, and moving to unprecedented escalation in the Middle-East between Iran and Israel. More precisely, the attack by Iranian forces on Israel and the pledge of the latter to retaliate had increase the possibility of the Iranian involvement in the war, which threatens the flow of Iranian oil supplies along with potential disruptions of shipments in the Persian gulf. Adding to that, possible reduction of Venezuelan supplies if the US were to reimpose sanctions on Venezuela as their president does not deliver on a promise of fair and free elections.

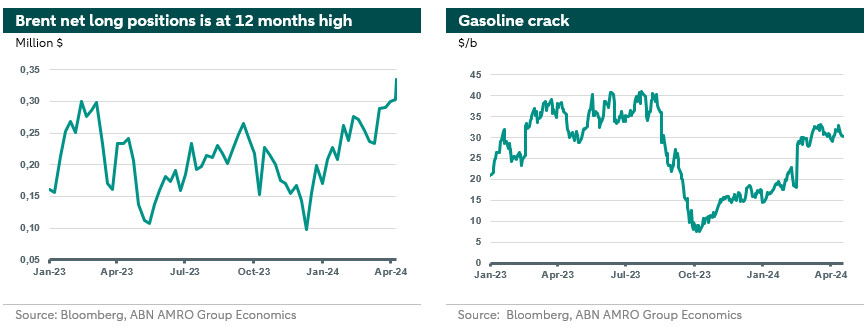

Against this background, markets appear very bullish on the outlook, with speculative net long positions reaching a 12-month high (see left hand chart below). Meanwhile, crack spreads have flattened out since the start of April as oil product cracks across the barrel weakened, neutralizing their effect on prices (see right hand chart below).

Possible scenarios for oil markets

Iran ranks amongst the 10 largest producers of oil. According to the IEA, Iranian supply is estimated to be around 3.25 mb/d in Q2 and Q3 of 2024, coinciding with a market anticipated supply deficit of 0.3 mb/d and 0.5 mb/d in the second and third quarters, respectively. Accordingly, if the war extends to Iran, large disruptions in oil markets to be expected. Even if crude supplies are not directly affected, the uncertainty of potential developments in the Middle East induced an estimated premium of around 8 $/b for the current geopolitical risks. In the worst, unlikely, scenario of a complete halt of Iranian oil supplies, the premium could be between 40% and 80% of the current price levels. That is, Brent could reach 140 $/b. On the opposite scenario of a de-escalation, the risk premium will decrease significantly and the attention will be back to the fundamentals. In that scenario, price should range around 82 $/b, taking into account the tightness in supply and the coverage of net long positions by investment funds. There is also a scenario where Iran disrupts the markets by (partially) closing the Strait of Hormuz. In such case we foresee 20-40% increase in Brent price. In the scenario of no escalation and no de-escalation, tensions and uncertainty will remain and markets will be volatile to any development or news, and the current premium will fluctuate accordingly.

We note that any American sanctions on Iran, Russia, or Venezuela are to be mindful to their impact on the crude markets especially since the US elections are just months away. Restoring sanctions on Iran and Venezuela would deepen the supply deficit and increase the bullish drive in crude markets. The question will then come down to whether OPEC+ would revisit of their cuts to bring the balance to the market or not.

Outlook

According to the above mentioned developments, and the latest subsequent signs of de-escalation, we have seen the risk premium in oil prices go down significantly, and confirmation of this further could see Brent oil prices trending around 85 $/b. We further think that OPEC+ will revisit their cuts for the second half of 2024. Accordingly, under the current available information, we retain our outlook for Brent in the second quarter to average 85 $/b and the end of year price of 90 $/b following the recovery in economic activity driven by the start of interest rates cuts in main markets.