New forecasts following US election

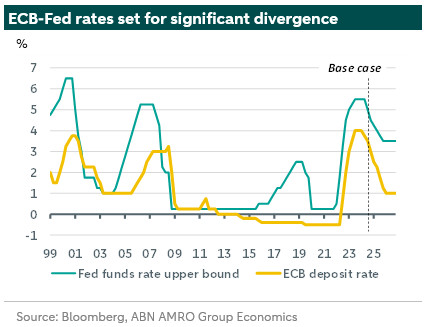

Global Macro: Growth & inflation tariff impact to drive Fed-ECB divergence – We are updating our growth and inflation forecasts in light of the US election result last week. While the election count has not fully concluded, the Republican party looks on course to win a House majority, to accompany the presidency and the Senate majority. By controlling all three branches of government, president Trump therefore has significant power to enact his policy platform. It remains highly uncertain how far Trump will go with his tariff plans, and so there is naturally high uncertainty around our new forecasts. But broadly speaking, the main outcomes of the plans are likely to be: 1) much lower eurozone growth and inflation than in our prior baseline, 2) significantly higher US inflation, and (ultimately) lower growth. This combination is likely to mean fewer interest rate cuts by the Fed, but more rate cuts by the ECB; this will in turn continue to weigh on the euro, which has already weakened significantly in recent weeks as markets moved to price in a Trump victory.

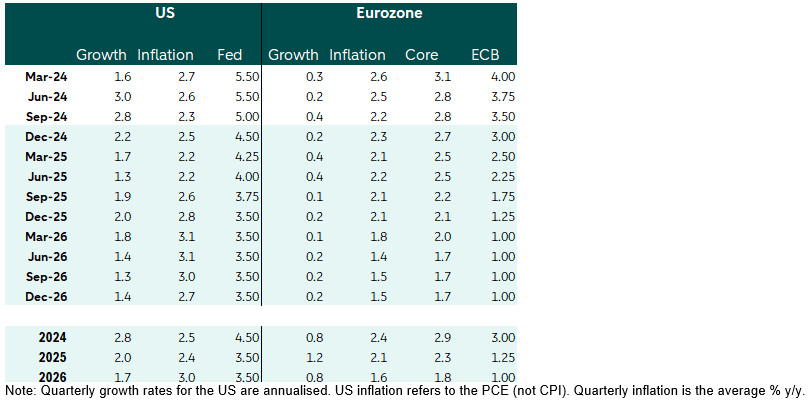

Below is a high-level summary of our new forecasts – next week Friday, we will publish our Global Outlook 2025, which will go more in-depth.

Our new base case

We assume a gradual stepping up of US import tariffs starting in Q2-25 (China, to 60%) and Q3-25 (rest of world, to rise by 5pp on average, on top of existing tariff rates). This is likely to drive a renewed divergence in US & eurozone growth, leading to extended rate cuts by the ECB to prop-up eurozone growth, but slower Fed rate cuts in response to upward inflationary pressure in the US. Before that time, activity in both eurozone and US growth may see a temporary lift; in the eurozone, from a front-loading of exports to the US to get ahead of the tariff rises, and in the US, from tax cuts and post-election euphoria (headline GDP growth is somewhat weaker due to higher imports, but domestic demand is strong).

Later in 2025 and into 2026, global growth will likely then face headwinds from the hit to global trade from tariffs, though we expect only targeted retaliation from the US’s trade partners as opposed to blanket tariffs. As such, outside the US, we expect inflationary pressures to remain contained, particularly against the backdrop of global excess supply, which continues to keep a lid on goods inflation.

Trump tariffs lead to significant eurozone growth & inflation hit…

We expect the eurozone economy to continue recovering in early 2025, before rising US tariffs hit exports later in the year and over the course of 2026. This ultimately leads to sharply lower growth, which then holds stubbornly below trend. Initially at least, the economy may benefit from some front-loading of exports to the US as businesses seek to pre-empt tariff rises. Alongside rising real incomes, improving confidence, and lower interest rates, this is likely to lift growth in early 2025. Thereafter we expect growth to slow. RRF flows will continue supporting growth in southern Europe until well into 2026, but export-oriented economies like Germany and the Netherlands will see an intensifying drag from US tariffs, weighing on growth especially in 2026.

We expect headline and core inflation to continue to decline, broadly reaching the ECB’s 2% target on a sustained basis in the first half of 2025, and undershooting the target in 2026 amid weak demand and lower energy prices. We expect the ECB to continue cutting rates at a once-per-meeting pace in the near-term, with a pause expected at the April meeting as the ECB assesses uncertainty over the outlook. We then expect more rate cuts than markets currently price, with the deposit rate eventually falling to 1% by early 2026 (from a low of 1.5% previously). This is driven by an undershoot in inflation and stubbornly below trend growth. (Bill Diviney, Jan-Paul van de Kerke & Nick Kounis)

…while pushing US inflation higher, and growth ultimately lower

The US economy is generally going into 2025 with strong momentum. Growth is strong, and inflation is approaching target. However, the labour market is slowing on the back of restrictive monetary policy, with gradually rising unemployment, and weaker jobs growth. Trump's victory is likely to significantly alter its course. We expect an initial improvement in economic sentiment, giving a boost to consumption and investment. The implementation of a wide fiscal stimulus plan and reductions in regulation give a further impulse to the economy. Tax cuts will not stop the deterioration in the labour market, but will feed inflationary pressure in 2025. The main impact comes from a gradual stepping up of tariffs in the course of 2025 and 2026, which add further to inflationary pressures, while the hit to trade slows down the economy. Frontloading of imports may also have a temporary negative effect on headline GDP growth in early 2025. The combined package leads inflation to move away from target over the course of 2025 and 2026.

In the near term, the Fed will continue its easing cycle. As policy is revealed and implemented, the Fed is forced to slow down the easing cycle to a 25bps cut once per quarter throughout 2025, giving more time to assess and evaluate the impact on inflation and growth. Elevated inflation means the Fed keeps rates somewhat restrictive at 3.5%, implying a further drag on growth well into 2026. (Rogier Quaedvlieg)

China

We assume the stepwise implementation of higher US import tariffs per Q2-25 to lead to an average tariff rate of 45% per Q2-26. While this tariff shock would be bigger compared to the first US-China tariff war in 2018-19, and will accelerate a decoupling in bilateral trade and investment flows, China looks better prepared now. It has reduced export/import dependence on the US and has developed a playbook to respond. Meanwhile, the economy is ending this year on a bit brighter note, with Beijing recently pivoting to demand management while trying to put a floor under real estate and stock markets. We expect Beijing to step up support further next year to offset the tariff impact. In the short term, net exports and GDP growth will profit from frontloading. We have cut our 2025 growth forecasts to 4.3% (from 4.5%). (Arjen van Dijkhuizen)