Eurozone - Subdued recovery is increasingly shaping ECB policy

The eurozone economic recovery is running out of steam, in part because of weak domestic demand. Labour demand is softening, especially in Germany, while the overall labour market remains resilient. Inflation fell sharply to 1.7% y/y in September, but elevated services remains a concern for the ECB. While the ECB has opened the door to a 50bp cut in December, a 25bp cut remains our base case.

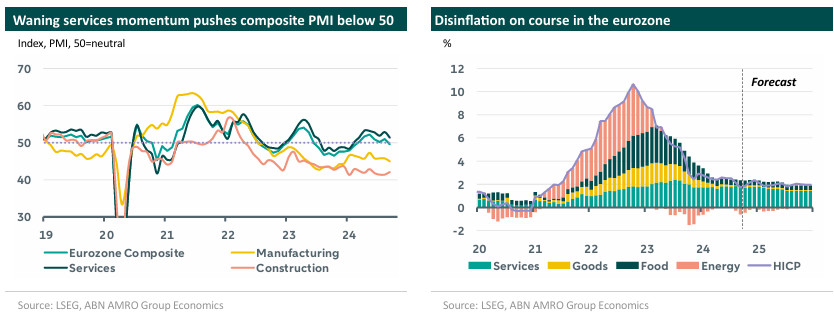

At the start of the fourth quarter the signs of a subdued recovery for the eurozone economy are mounting. For the second month in a row the composite eurozone PMI stayed steady at levels consistent with a small decrease in business activity. Core countries Germany and France are leading the charge. Up until recently the drag on activity from the German and French manufacturing sectors was offset by expansion in the services sectors, driven in part by strong catch-up demand from consumers. But as the momentum in the services sector faded, overall activity in Germany and France is now in clearly in contractionary territory. This does not translate one to one to GDP. Since the pandemic the link between PMI’s and GDP has become looser. Still, that the eurozone is set for a subdued recovery is clear. Should German Q3 GDP (out tomorrow) be negative – as the Bundesbank expects – the largest economy of the eurozone would technically be in a recession already. For now, we anticipate the eurozone aggregate to expand by 0.2% qoq in Q3, but it is clear that risks to the downside of our Q4 forecast of 0.2% qoq are building.

In the final month of the third quarter disinflation remained on track. Inflation in September fell below 2% for the first time since early 2021 to 1.7% y/y – revised down from 1.8% in the flash estimate, and down from 2.2% in August. Core inflation also fell from 2.8% y/y to 2.7%. Looking at the details we see services inflation, which remains a concern of the ECB, remaining stubbornly elevated at 3.9% y/y, in part by the pass-through of past and current high wage growth. Looking ahead, in the coming months, inflation is expected to edge higher again due to less favorable base-effects in energy. In the medium term however, we expect disinflation to continue, eventually also leading to a lower pace of price rises in the services sector, as the macro environment will reign in the ability to pass on cost rises, while lower labour demand should ease wage cost-push pressures.

At the October meeting the ECB lowered the deposit rate by 25bp. In the policy statement and in the press conference the ECB shifted tone, explicitly mentioning that risks to inflation are geared more towards the downside as a result of the stalling economic recovery in the eurozone. Following that meeting more dovish commentary by Governing Council members followed, raising the prospect of the ECB stepping up the pace of rate cuts with a 50bp move in December instead of keeping the pace at 25bp cuts. While the backdrop of a further stalling recovery strengthens the case for less restrictive monetary policy, the data up until now has likely not yet sufficiently deteriorated to warrant such a step-up to 50bp cuts at present. Between now and the December meeting, the ECB will receive GDP & negotiated wage growth data for Q3, two more inflation reports, and another PMI report. More importantly, for the ECB to consider such a step-up, we believe a material slowdown in growth indicators and/or domestic inflation (services inflation) from current elevated levels would be needed. Given our base case sees growth holding at current subdued levels, and inflation continuing to slowly ease, we stick to our view that the ECB will cut rates by 25bp in December as well as each following meeting until the ECB reaches our estimate of neutral at 1.5%.