China - Year of the Dragon kicks off with some green shoots

Deflationary pressures stronger, but Lunar New Year holiday data bring some green shoots. PBoC continues with small policy rate cuts, while targeted lending drives balance sheet expansion. Quarterly growth to pick up compared to Q4-2023; risks to our forecasts are balanced.

On 10 February, the Year of the Dragon kicked off, followed by the usual one-week public holiday. Due to the different timings of the LNY break each year, monthly activity data in Q1 can show distortions, and fewer monthly data are published. Recent data still paint the picture of an uneven recovery – with ongoing headwinds from property, and the supply side still stronger than the demand side – but there are some green shoots. Meanwhile, in line with our expectations, Beijing continues with measures to safeguard growth, stabilise real estate and restore confidence. We still think this will help qoq growth to pick up a bit compared to Q4-23, with risks to our forecasts balanced. Further policy guidance will be given at the annual NPC starting on 4 March, when the 2024 growth target will be set: a target of ‘around 5%’ is likely.

Deflationary pressures stronger in January; LNY holiday data bring some green shoots

January PMIs showed a modest improvement, with the official composite PMI rising to a four month high of 50.7, and Caixin’s composite PMI stable around 52.5 (see our comment here). That said, the manufacturing components of both surveys show the supply side is still stronger than the demand side. This is also reflected in the latest inflation data. CPI inflation for January came in at -0.8% yoy, the weakest annual number since 2009. While this is strongly impacted by food prices, core CPI fell to a three-year low of 0.4% yoy, showing weak demand is also weighing on underlying inflation. We still expect deflationary pressures to ebb in the course of 2024, but have cut our average CPI forecast for 2024 further to 1.0% (from 1.5%). Turning to growth indicators, monthly lending volumes came in at record highs in January, reflecting seasonal effects and government support, but remained subdued in annual growth terms. By contrast, LNY holiday related data brought some green shoots – with e.g. tourism spending and trips up by 8% and 19% compared to pre-pandemic levels, although the 2024 break was one day longer, and spending per trip was 9.5% lower than in 2019 (also see global theme).

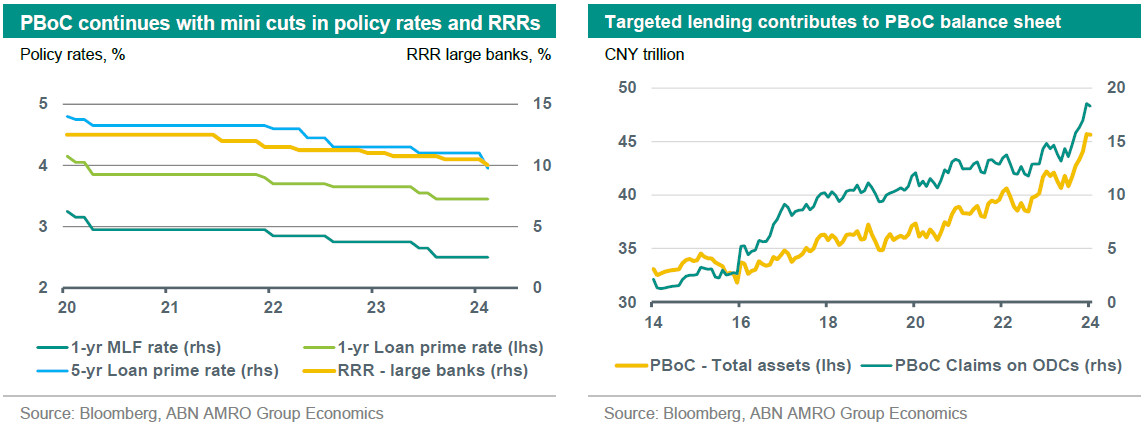

PBoC continues with piecemeal rate cuts; targeted lending facilities contribute to PBoC balance sheet expansion

In line with our expectations, Beijing continues with piecemeal monetary easing and targeted support, in an attempt to safeguard growth and break the negative feedback loop in the property sector. Following the 50bp cut in bank RRRs announced in January, in mid-February the 5-year loan prime rate (a benchmark in mortgage lending) was cut by a record 25bp, to 3.95%, while other policy rates were left unchanged. We expect further mini policy rate cuts throughout 2024. What is more, as we flagged in earlier publications, the PBoC continues with a quasi-fiscal, targeted lending tool (the Pledged Supplementary Lending facility) – which totals around CNY 500 bn so far. The PSL enables certain policy banks to provide low-cost funding to the so-called ‘three major projects’ (urban village renovation, affordable housing, emergency infrastructure). This sort of ‘China-style QE’ is also visible in the PBoC’s balance sheet, with claims on ODCs (other depository corporations) rising at the fastest pace since 2016 (see chart). Meanwhile, Beijing’s latest attempts to stabilise the stock market – including amongst other things a sharp tightening of (short) selling restrictions –seem to have contributed to the CSI-300 index regaining around 10% over the past weeks, following a decline of 45% in the preceding three years.