The Netherlands - First signals of easing labour demand

Dutch inflation is coming down: we expect it to average 4.8% in 2023 and 3.5% in 2024. We see the first signs of somewhat easing labour demand. Unemployment rate crept up to 3.7% in September. House prices are rising slightly after a relatively short-lived decline.

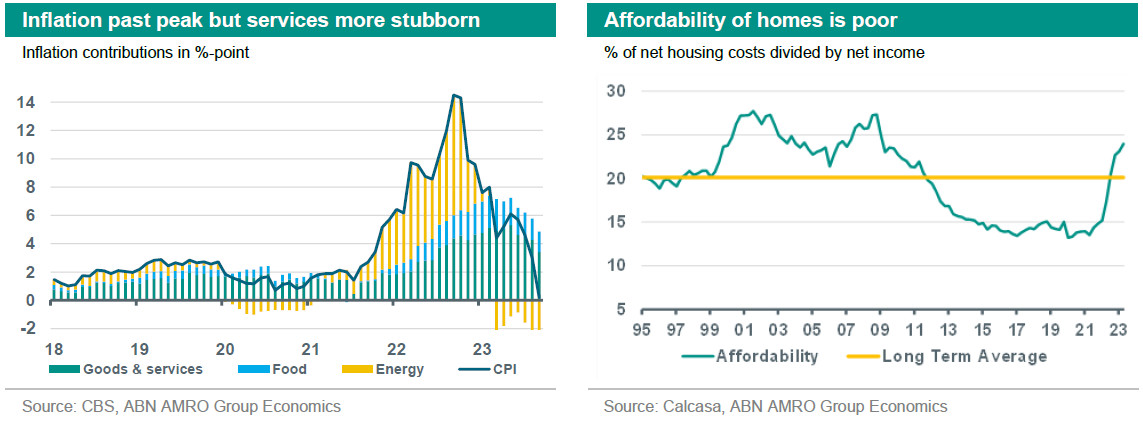

After a strong post-pandemic recovery, 2023 has been a more challenging year for the Dutch economy. Following a technical recession in the first half of 2023, we expect only slightly positive (or stagnating) growth for the second half of the year. The weakness has been driven by the inflation shock to household purchasing power, and weak external demand for Dutch exports. Monetary tightening and weak external demand will continue to weigh on the economy well into 2024, with growth expected to remain sluggish. The broad slowing in economic activity is visible across sectoral confidence indicators. The measures presented on Prinsjesdag (the Budget Day in the Netherlands) and those announced during the budgetary debates in the days after, are expected to have a limited macro impact. We expect growth to return on the back of private consumption, as it will – in the fourth quarter – be lifted by wage growth and a one-off energy allowance for this year. Dutch inflation is coming down; in September it dropped to -0.3%. While a positive development, caution is warranted: the headline figure is being pulled down by the strong negative contribution of energy. Underlying, we see that core inflation is also coming down but remains elevated at 5.1%. Wage growth is a significant driver of services inflation in particular. Wage growth is slowing but remains historically elevated. Inflation in the Netherlands is therefore unlikely to return to the ECB’s 2% anytime soon; we expect inflation to average 4.8% in 2023 and 3.5% in 2024.

The labour market plays a key role in wage growth developments. Although it remains tight from a historical perspective, we now see the first signs of somewhat easing labour demand. For example, employers’ employment expectations of three months’ ahead are stabilizing. We also see a small drop in the number of job openings. Even so, we also continue see signs of labour hoarding: employers prefer to keep their employees and reduce their hours rather than lay them off. This is reflected in a decrease in the number of hours worked. The total number of jobs has remained fairly constant, but under the hood it appears that private labour demand has declined slightly while public sector jobs (healthcare, government and education) have increased. All in all, the unemployment rate crept up to 3.7% in September – still a historically low rate.

Despite the poor sentiment in the Dutch housing market, prices are rising slightly after a relatively short-lived decline. Prices have risen for 3 consecutive months and set a bottom in May after almost a year of declining prices. Despite the price increase, sentiment has been relatively subdued. Due to the significant increase in interest rates, home affordability has worsened. Looking forward, the continuation of strong wage growth along with a decrease in interest rates in the long term should positively impact affordability. Therefore, prices are seeing upward pressure because of the positive outlook on wages and stable mortgages rates, but also because of the looming shortage in available houses and lagging supply. The combination of low affordability, high demand and the lack of suitable supply will put downward pressure on transactions. Housing inventory for sale has fallen because existing homeowners are less likely and able to move amid high mortgage rates.